Though the battery industry is undergoing seismic changes, leaders at Clarios, Crown, East Penn and EnerSys all see a bright future ahead

Leading executives agree that the energy storage landscape is entering one of the most formative periods in its history. But these industry leaders also agree that the future of the battery industry is bright – and that incumbent firms are more than equal to the challenges ahead.

“We live in the most dynamic period in the history of this business and this industry. Just think of all the things that are changing at the same time, from product mix to manufacturing processes to cost structures. ” said Dave Shaffer, President and CEO of EnerSys. “We know that technology shifts are occurring and we have to adapt with the times. And I couldn’t be more excited about the future.”

Shaffer and three other battery manufacturing executives came together for a dynamic and forward-looking discussion at the BCI 2024 Convention + Power Mart Expo in Fort Lauderdale, Fla., on April 22. Panelists included included:

- Hal Hawk, President and CEO of Crown Battery Company

- Chris Pruitt, President and CEO of East Penn Manufacturing

- Dave Shaffer, Director, President and CEO of EnerSys Inc.

- Mark Wallace, President and CEO of Clarios

Their firms and professional experiences varies, but all four leaders offered a similar message over the course of their one-hour discussion: That these are incredibly interesting times in battery business, and that firms focused on the future instead of the past will make the most of the tremendous opportunities ahead.

An evolving automotive marketplace

One of the biggest changes for energy storage is the related changes happening in the automotive marketplace, including the continued evolution of modern vehicles. That includes the shift from internal combustion engines to electric drive trains, but also a host of other high-tech add-ons that place greater power demands on a vehicle than ever before.

“The vehicle is becoming more complex,” said Mark Wallace of Clarios. “The growing electrical demands on the low-voltage networks are significant, including functional items like steer-by-wire, brake-by-wire, and active chassis capabilities.”

He noted that some automakers are even moving towards multiple low-voltage batteries to support onboard technology. And while a lot of the hype is around lithium drive train batteries, Wallace stressed that industry leaders like Clarios are looking at more than just what makes a car move – including advanced low-voltage lead batteries.

“We approach it more from a chemistry agnostic approach, where we can provide a wide range of chemistries based upon the actual engineering application need,” Wallace said. “That’s a real opportunity because ultimately there’s not a lot of people in the world that really know low voltage systems. And I think a lot of us in the room have spent our careers in or around this space, and this is where I think we can continue to be leaders in our foundational business.”

Replicating lead’s sustainability and safety success

Building off comments about the changing mix of battery chemistries and products, panelists agreed that its critical that emerging technology trends learn the hard-fought lessons of sustainability and success won by the lead battery manufacturing industry.

“Our industry has been doing ESG for a hundred years. It’s just different how we talk about it and label it now,” said Chris Pruitt of East Penn. “To reduce energy consumption – why wouldn’t you want to do that? To reduce water consumption – why wouldn’t you want to do that? The lead battery industry learned these lessons a long time ago and we should stand tall and be proud of what we’ve achieved.”

Dave Shaffer of EnerSys added that strong environmental, health and safety standards also the protect workers and the hometowns of BCI’s member firms.

“We all work so hard on best practices and EHS standards because there’s no room for error, and what happens to one of us happens to all of us,” Shaffer said. “The fact that our blood lead levels are voluntarily twice as restrictive as the federal OSHA standard says something about how much we care, and how seriously this industry takes health and safety.”

Hal Hawk of Crown Battery stressed that the circular economy of lead batteries and the high standards of safety should provide an example to how the energy storage industry of the future should work, and how industry and policymakers can work together.

“BCI has done a great job bringing together and educating all of the stakeholders so we can all understand the pragmatic realities and build on 100 years of experience as an industry,” he said. “We’ve learned so many hard lessons and the system is better thanks to us. But it’s important to deal with the practical realities, so that the business of making any kind of batteries remains fair and remains economically and technically feasible across the U.S.”

AI, supply chain challenges of a changing global economy

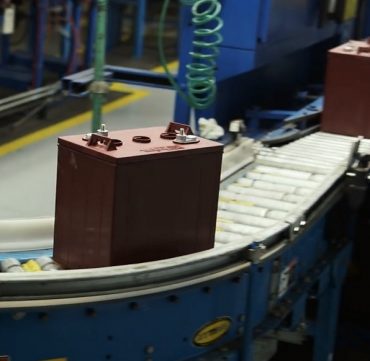

Like many other industries, battery manufacturers are looking seriously at artificial intelligence and automation as a way to stay relevant in the future. Clarios CEO Mark Wallace noted that this isn’t just about looking for efficiencies, but also about ensuring the basic production throughput of an energy storage business.

“Some people might think AI is taking away jobs, but if you’re manufacturing it’s quite difficult today to find any kind of labor at all. And we have to have consistent flows of labor to operate,” Wallace said. “Automation and AI can be expensive, but as we look at deployment of capital it’s almost a requirement now to figure out ways to do more with less people – because we just can’t hire enough people today, particularly here in the U.S.”

In addition to automating physical production, Wallace said AI also can play an important role in organizing and analyzing all the large sources of data across the industry to find efficiencies in run sizes, factory schedules, inventory, and other areas.

Another challenge in the modern energy storage landscape is the nature of supply chains for manufacturers. East Penn CEO Chris Pruitt noted with pride that his firm has been headquartered in Pennsylvania for 77 years and invests heavily in its hometown of Lyons Station, Pa. However, even in friendly territory it can be a challenge to build out the domestic infrastructure that the industry may need based on current demand trends.

“There’s actually a trade deficit in the lead battery industry in North America, primarily thanks to a deficit in recycling capacity,” Pruitt said. “Could North America use another smelter or two? Absolutely. But even when it comes to building smaller industrial properties like a warehouse, communities sometimes want to fight it. So how do we correct that, so that junk batteries aren’t exported to be recycled elsewhere and take that important metal out of an otherwise circular domestic supply chain?”

Not only would such an effort protect the materials battery manufactures need, Pruitt said, it could also cut down on the red tape and costs that come with importing lead, lithium, or any other critical battery mineral.

In the absence of that kind of supply chain improvement, Hal Hawk of Crown Battery noted that it’s up to manufacturers to diversify and troubleshoot their supply chain to ensure they can continue to operate effectively.

“We run audits on our suppliers to go out and visit with them to make sure their reliable. That goes for physical delivery and pressures on long supply chains from Asia, but also other issues like cybersecurity because we simply can’t afford a disruption of any kind,” Hawk said. “Not all suppliers are happy with us as we’ve diversified, because now we don’t just have one or two big partners, and the pie gets split into smaller pieces. But it’s necessary to provide the safety and security we need to effectively run our business.”

As the battery industry evolves, he added, it’s crucial for policymakers to acknowledge the realities of how America’s energy storage companies operate and the risks of putting short-term profits ahead of long-term stability, added Dave Shaffer of EnerSys.

“The U. S. cannot become just an assembler nation where we buy all these pieces from around the world and just put them together to maximize profit,” Shaffer said. “We really have to understand at our core that control over the supply chain matters. Not just for the jobs on the production line, but for all jobs and for the national supply chain as a whole.”

Global competition in the battery industry

Digging deeper into Asia, the panelists agreed that competition from China is a serious competitor in the modern energy storage landscape in North America and Europe.

“The West is at a major crossroads,” said Mark Wallace of Clarios. “When you look at most chemistries in the world today, you know, China’s ahead. And I don’t mean just ahead with the ability to build a cell, but the mining and processing of materials.”

It doesn’t have to be that way, however. Wallace noted that lithium iron phosphate batteries – a chemistry where Asian businesses currently dominate the supply chain – are powered by research developed in part by Texas A&M years ago.

Shaffer of Enersys noted that other global jurisdictions sometimes don’t have the same stringent health and safety standards that the U.S. does, either.

“In the U.S., this is an industry where you have to wear a uniform, you have to get blood lead tests and have PPE. This is an industry that is seeing increasingly strict ambient air standards,” Shaffer said. “All of that is important. So even if it wasn’t just about supply chains and competitiveness, it’s also about making sure there’s a level playing field and that everyone is thinking globally about things like sustainability and not just about local emissions or risks.”

These global challenges along with the pressures of innovation and an uncertain regulatory environment means the pace of change is brisk in the energy storage industry. That’s unlikely to change anytime soon, but panelists agreed that the dynamic environment in 2024 provides a unique opportunity to think critically about the future.

“We should all be really excited that batteries are talked about every single day,” said Chris Pruitt of East Penn. “We’re in that game! And yes, it may be different chemistries in the future. It may be different types of batteries. But we have 100 years of experience and expertise that will make us relevant for another 100 years. If we continue to innovate and be good stewards of our companies, our workers and the environment, we’ll do better than just survive this. We will thrive for many years to come.”