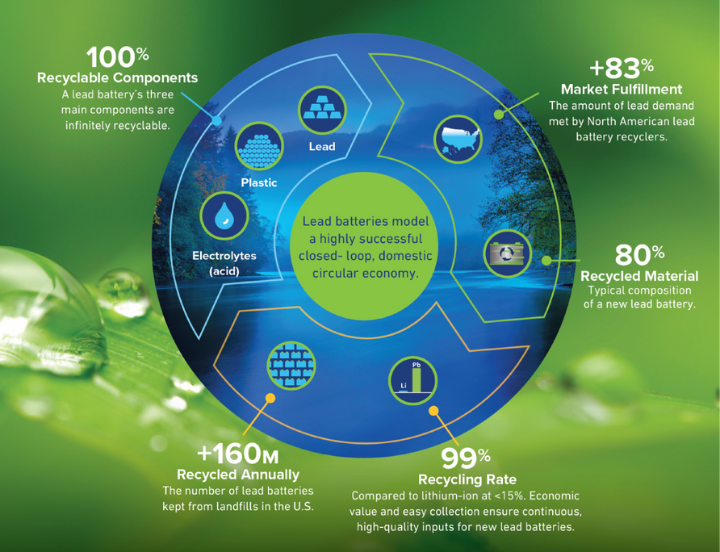

The United States should not rely on unstable foreign countries to meet critical energy storage needs. The lead battery industry has an established network of domestic manufacturing, collection and recycling facilities. Together, they create a circular economy that ensures consistent lead battery fulfillment and quick scalability within the U.S.

Domestic Infrastructure Ensures Reliability

North America’s lead battery industry is ready to “Build Back Better.” It thrives on an established domestic infrastructure that...