2023 sales exceeded $2 billion; energy storage systems to drive phenomenal growth

The demand for industrial lead batteries in North America exceeds two billion dollars, with huge opportunities ahead in the energy storage systems (ESS) sector. So how do lead battery manufacturers capitalize on today’s demands while remaining dedicated to innovation?

That thought-provoking question was posed by battery expert Nick Starita during his presentation at the 2024 BCI Convention + Power Mart Expo, held April 21–24 in Fort Lauderdale, Florida. Starita is president of the Energy Solutions Division at Hollingsworth & Vose, a global manufacturer of advanced materials used in filtration, battery and industrial applications.

A wealth of information on industrial lead batteries

His presentation, “North American Industrial Lead Battery Market Forecast ‘24–’26,” provided an overview of the two distinct industrial lead battery market sectors: motive power batteries (also known as traction batteries) and stationary batteries, which are used for standby power (also defined as emergency power).

Starita’s overarching messages included:

- North America Industrial Lead Battery Market was over $2.3 billion in 2023.

- Lead battery remains a valuable energy storage solution.

- Opportunities:

– Stationary batteries that offer longer life and temperature-tolerance improvements.

– Motive Power benefits that offer maintenance-free and fast-charging. - Alternative technologies will capture new growth.

- ESS will be the biggest business opportunity in a lifetime.

2023 Motive Power: OEM electric industrial lift truck shipments soar

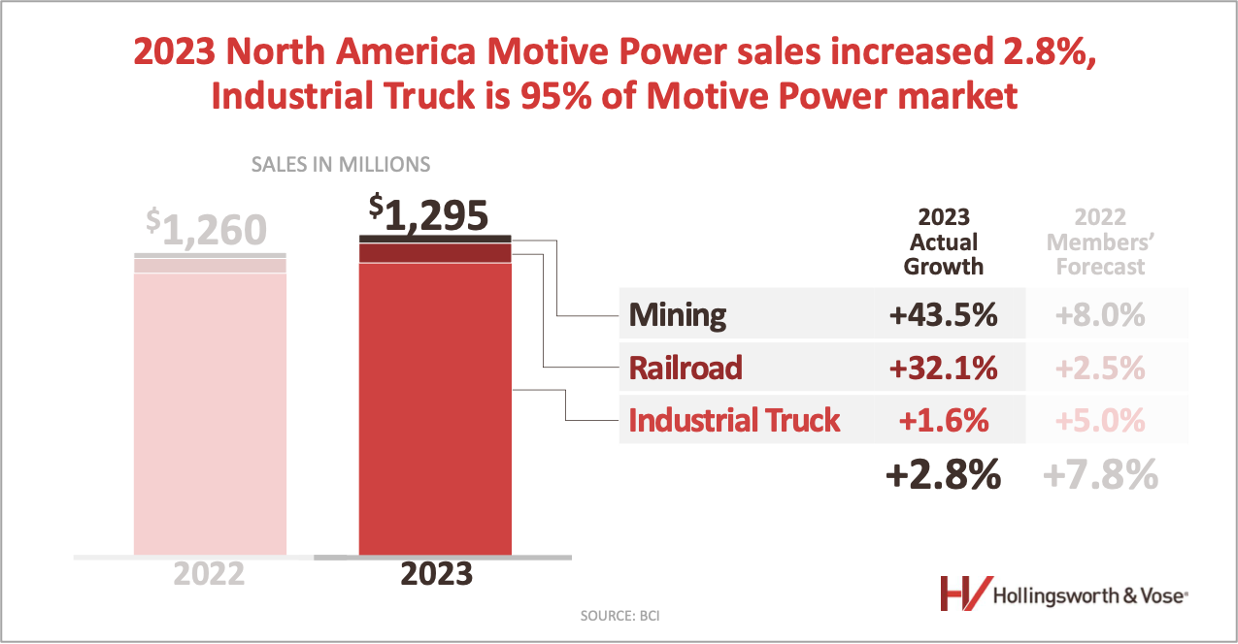

Starita reported that the Industrial Truck Battery Market is currently 95% of the Motive Power Market, with BCI members accounting for 85-90% of lead batteries here. A motive battery powers the motor that drives an electric industrial vehicle, such as a forklift, as well as accessories like headlights and other safety features.

Data shows North American motive power sales have a CAGR of 3.3% since 2016. Actual growth in 2023 shows an increase of 2.8% to about $1.3 billion:

- Industrial trucks (about 95% of the market) up 1.6%.

- Railroad up just over 32%.

- Mining up 43.5%.

U.S. Industrial Truck battery market:

- Units decreased 1.5% in 2023 (accounting methodology is voltage-based.)

- CAGR fell about 2% between 2016 and 2023.

- Most of the North American industrial truck battery volume is in the U.S.

OEM Electric Industrial Lift Truck shipments according to Industrial Truck Association (ITA):

- Another record year: Up over 18% in 2023.

- CAGR of almost 5% from 2016.

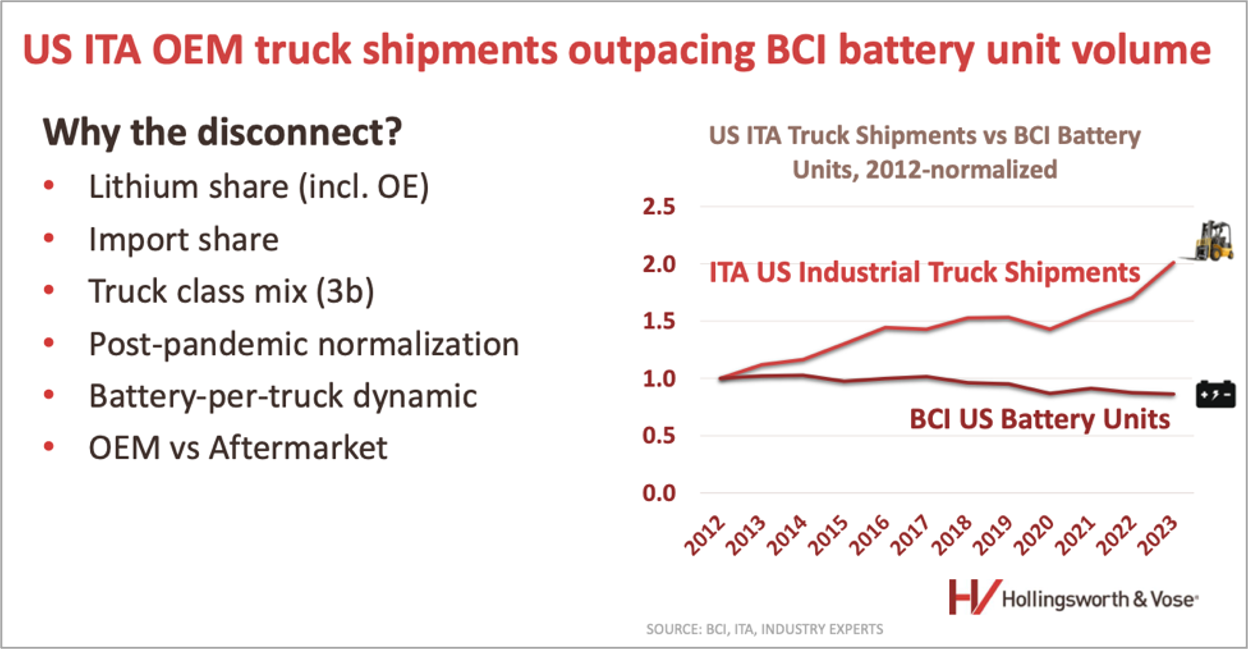

US ITA OEM truck shipments outpaced BCI battery unit volume:

- CAGR was almost 5% between 2016 and 2023.

- 2023 growth was over 18%.

Starita elaborated on why battery units have remained flat while industrial electric truck shipments are increasing at record pace. Driving the disconnect are several things. Among them are lithium gains, import share, a mix of truck classes, and post-pandemic normalization. Yet, electrification is an opportunity for lead and other chemistries.

Motive power trends

Influential factors in motive power include ICE bans, corporate ESG goals, lithium share, and automation, which continue to push electric. Lead batteries will benefit as truck OEMs continue to push automation and data systems, which batteries enable. Productivity is big, too.

“You never want the battery to be the reason for (downtime), so you want maintenance free, fast charging, longer life,” Starita added.

BCI members’ motive power forecast: over $1B

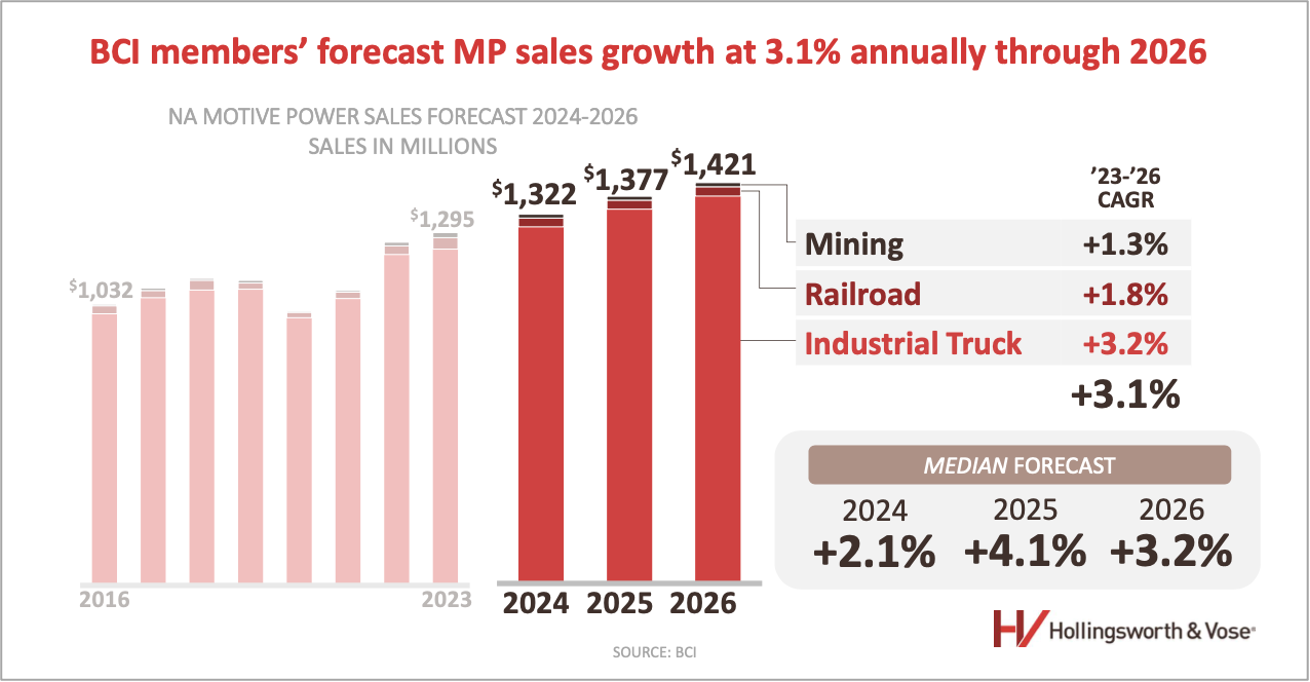

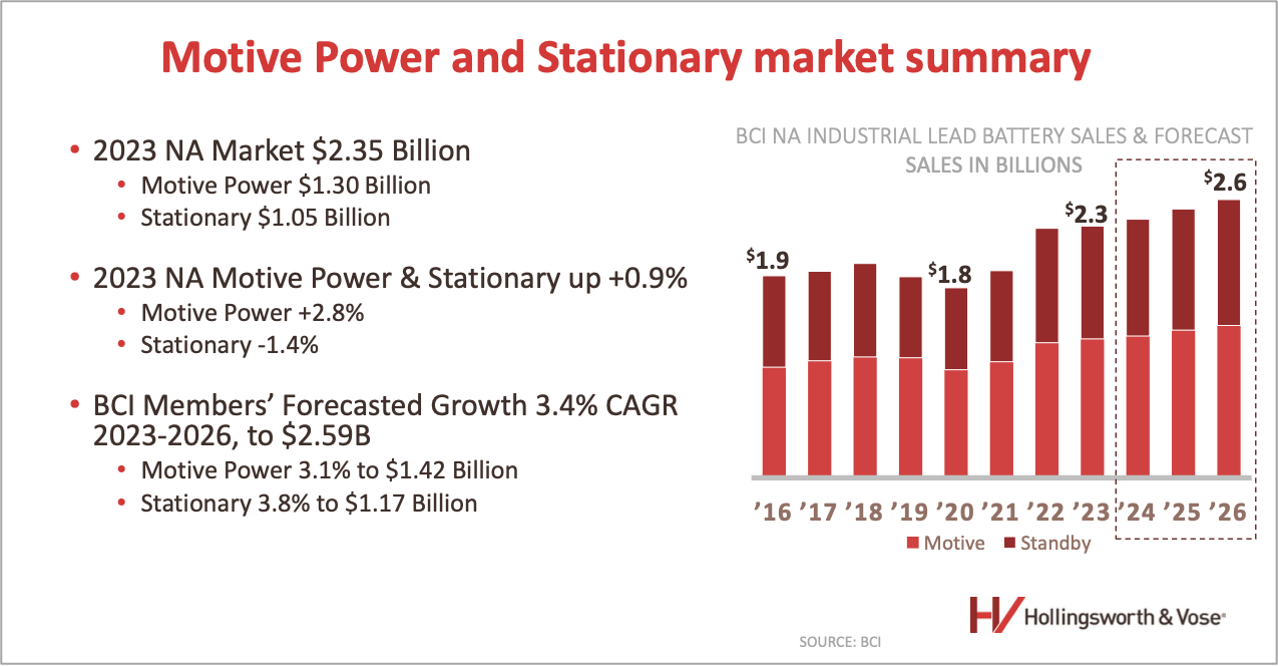

BCI members are forecasting about 3.1% annual growth through 2026, up to about 1.42 billion units. Increases will occur in all three market segments: industrial truck, rail, and mining.

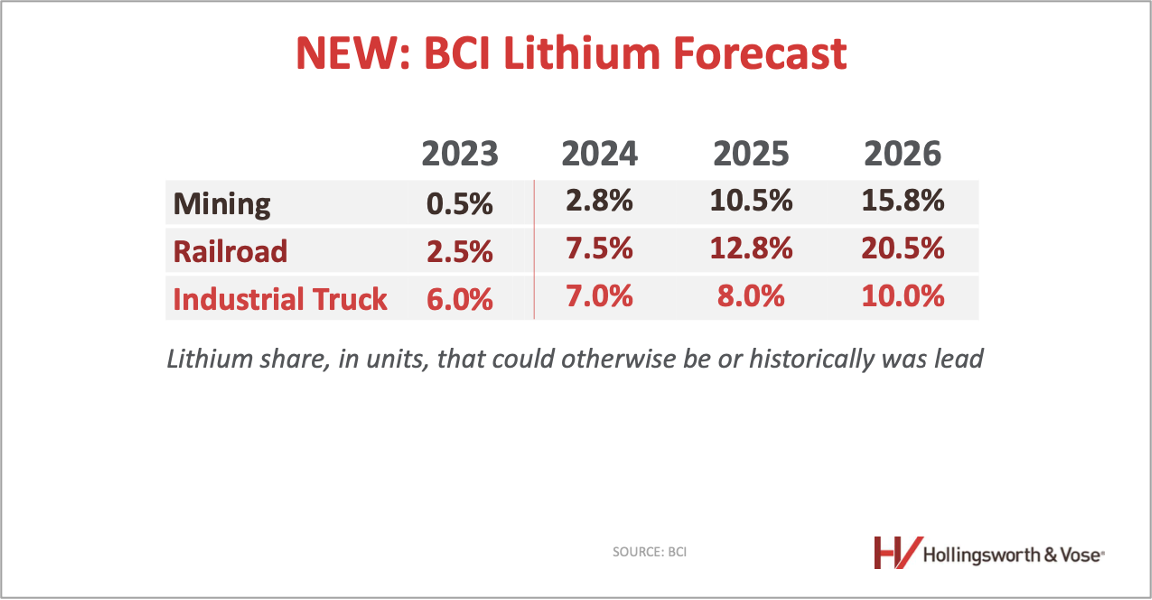

NEW lithium motive power forecast

New to his presentation this year, Starita added a BCI members’ lithium forecast. The numbers show a steady pace for lithium units to capture market share. “We asked members to estimate the lithium share in units, not dollars, that could otherwise have been historically lead [batteries].”

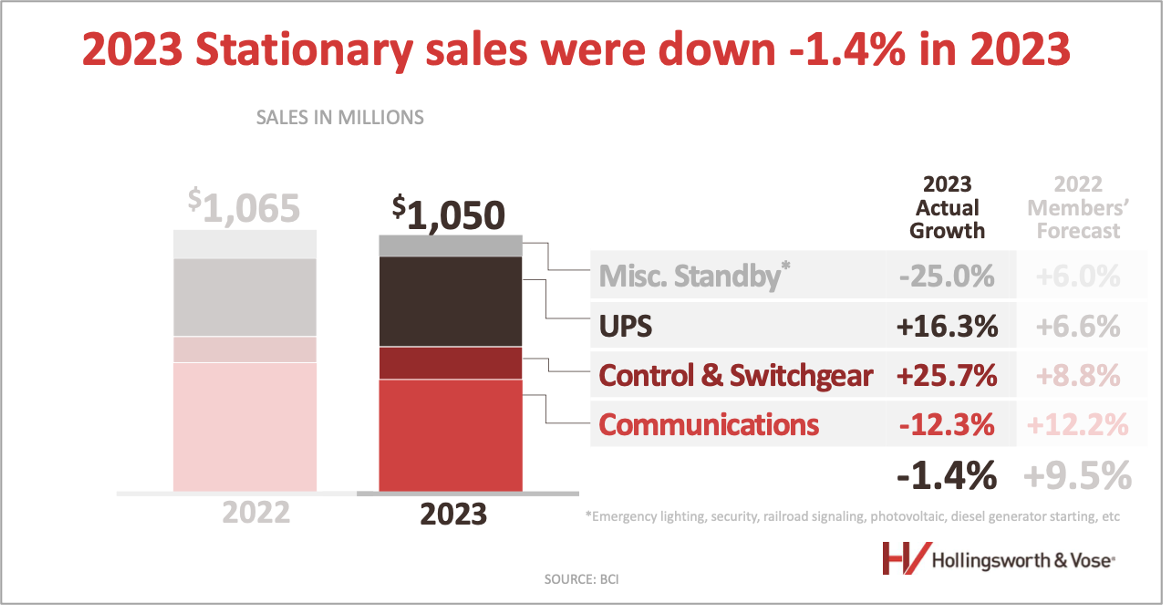

BCI members’ 2023 stationary power sales

BCI members reported their 2023 stationary battery unit sales were down nearly 1.5% in 2023 to just about one billion dollars.

“Long-term, the compound annual growth rate at three percent is a little bit misleading, because … this market can bounce around a good bit. It’s really application driven.”

Other data points Starita shared:

- Despite volatility, stationary power overall CAGR is positive, at 3% since 2016.

- Mix trend toward VRLA monoblocs for decentralization, scale and ease of integration.

Stationary sales overview by-segment

Communications (also known as telecom) – sales down 12.3% in 2023 to $464 million.

- Starita noted a rapid slowdown, due to slower 5G pace and economy uncertainty.

- High-temp tolerant lead battery trend continues (for life and operating cost savings).

- BCI members have about 85-90% lead battery market share.

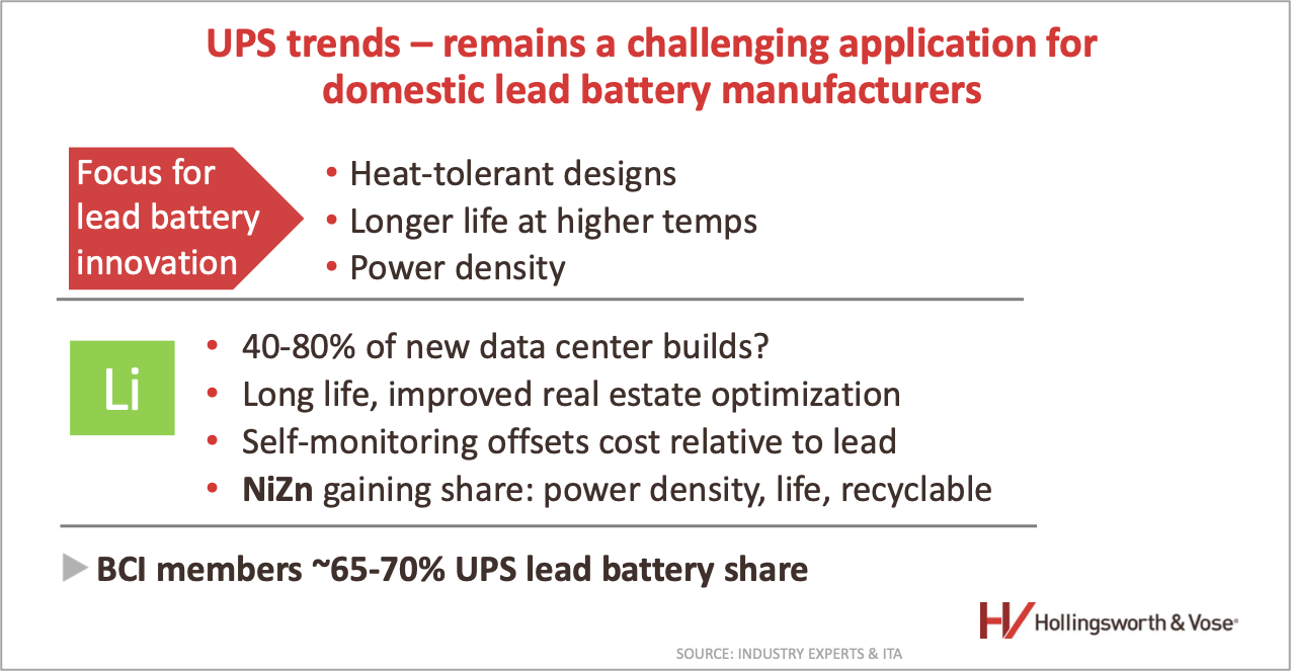

UPS (uninterruptable power supply –data centers are biggest user) – sales up 16.3% in 2023 to $367 million.

- CAGR is 4% between 2016 and 2023.

- Forecast for 2023–2030 is for data center growth to increase by 80% from 19GW to 35GW.

- BCI members have 65-70% UPS lead battery share.

“Data centers is an absolutely amazing market. There’s definitely a rising tide … it’s all driven by AI.” As great as this sounds, Starita said there are warning signs for lead batteries, which must innovate to “stay in the game.”

Miscellaneous Standby (emergency lighting, security, microgrid, etc.) – sales down 25% in 2023 to $86 million, due to large drop in VRLA monobloc.

Control & Switchgear (utility market) – sales up 26% in 2023 to $133 million, with surges across all three battery types.

The growing demand for electricity will drive demand for substations and switchgear (data centers, semiconductor and giga-factories, EV charging networks). Flooded batteries will see most growth, but 2V VRLA will also grow.

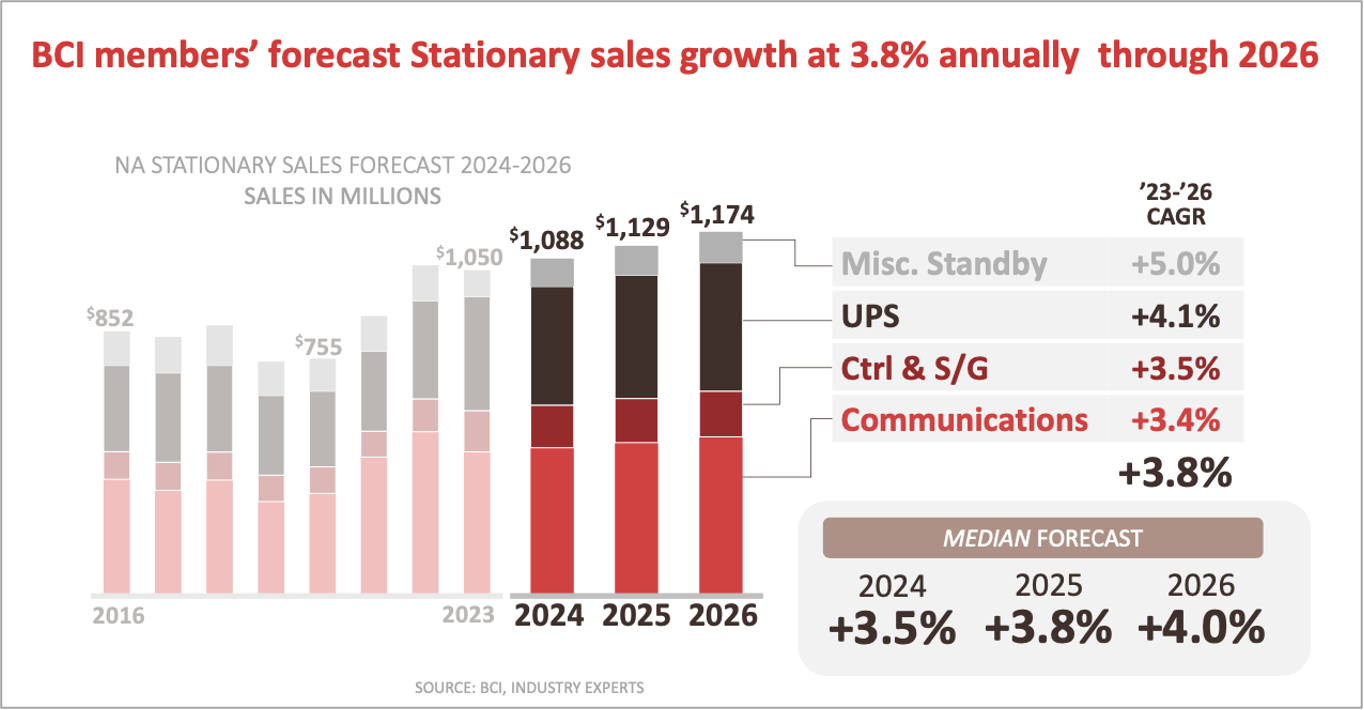

BCI members’ stationary sales forecast

BCI members forecast stationary sales growth at 3.8% annually through 2026.

NEW lithium stationary market forecast

Starita added a BCI members’ lithium battery forecast for the stationary market. As with motive power, lithium’s market share will rapidly increase across all four market sectors between 2023 and 2026. Most notable, UPS will grow from about 28% to 43%; communications will grow from 3.5% to 8%.

Summary: motive power and stationary markets

The North American industrial battery market – motive power and stationery combined – was over $2.3 billion last year, which is up about 1% overall.

The biggest opportunity: energy storage systems (ESS) market

“Everybody knows this market is going to be absolutely enormous,” Starita proclaimed.

BCI members reported $6.4 million in ESS sales in 2023. “This market could potential be hundreds of billions of dollars.” He attributed the prediction to the incredible growth of electricity demand and decarbonization of the grid. For lead to complete, the industry will need to change its mindset from “a lead battery sale” to an “engineering system solution.”

Lead battery innovation is essential to compete

Starita concluded by saying, “There’s not one magical battery that can do everything. Lead certainly isn’t that, neither is lithium. There are a bunch of use cases growing … and alternative technologies will capture some of that, and so will lead.

“The question is, how do we innovate for the future while capitalizing on today?” Time will tell.