A new report highlights the enduring role of advanced lead batteries in the evolving U.S. vehicle marketplace, and forecasts modest but continued growth for the years ahead.

From starting traditional combustion engines to supporting critical systems in zero-emission vehicles, batteries serve a critical purpose in U.S. cars and trucks. According to BCI data and analysis by commodity research firm CRU, production of these essential lead batteries was up 3.9% in 2024 and is expected to grow an additional 2.5% through 2025.

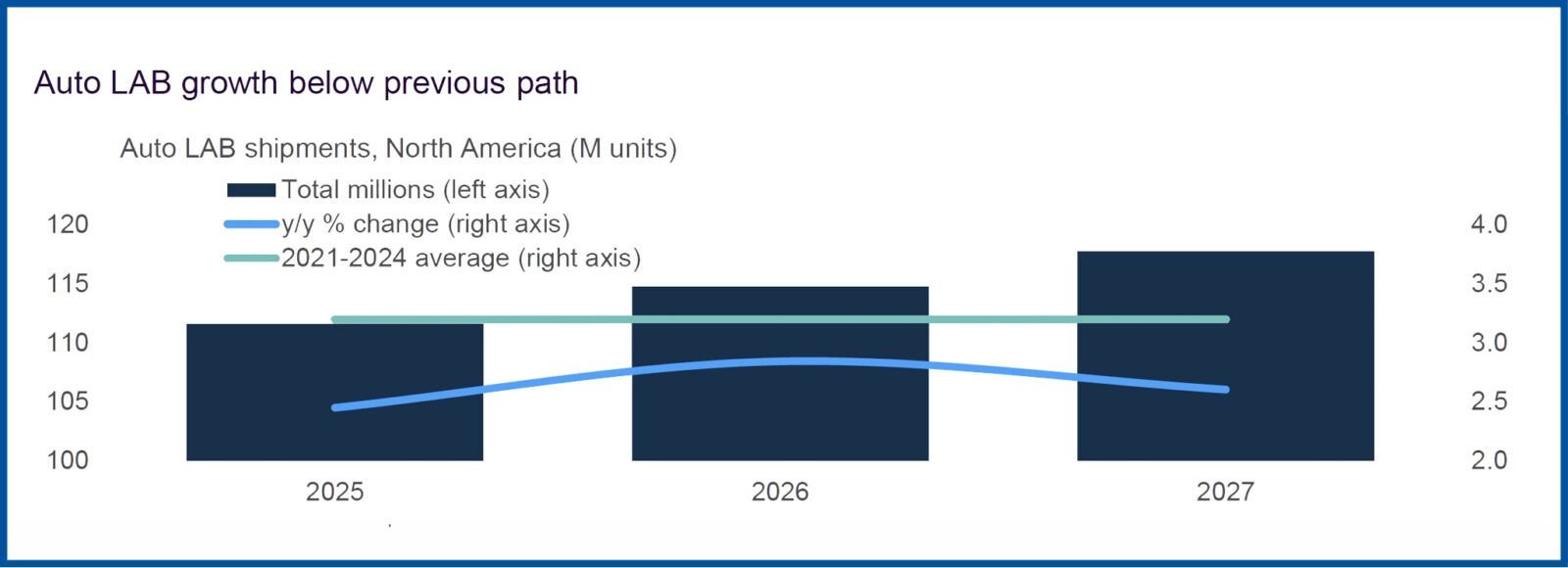

The report by BCI and CRU on battery market trends also forecasts 2.8% growth for automotive lead batteries in 2026, and 2.6% growth in 2027 despite recent trade uncertainty.

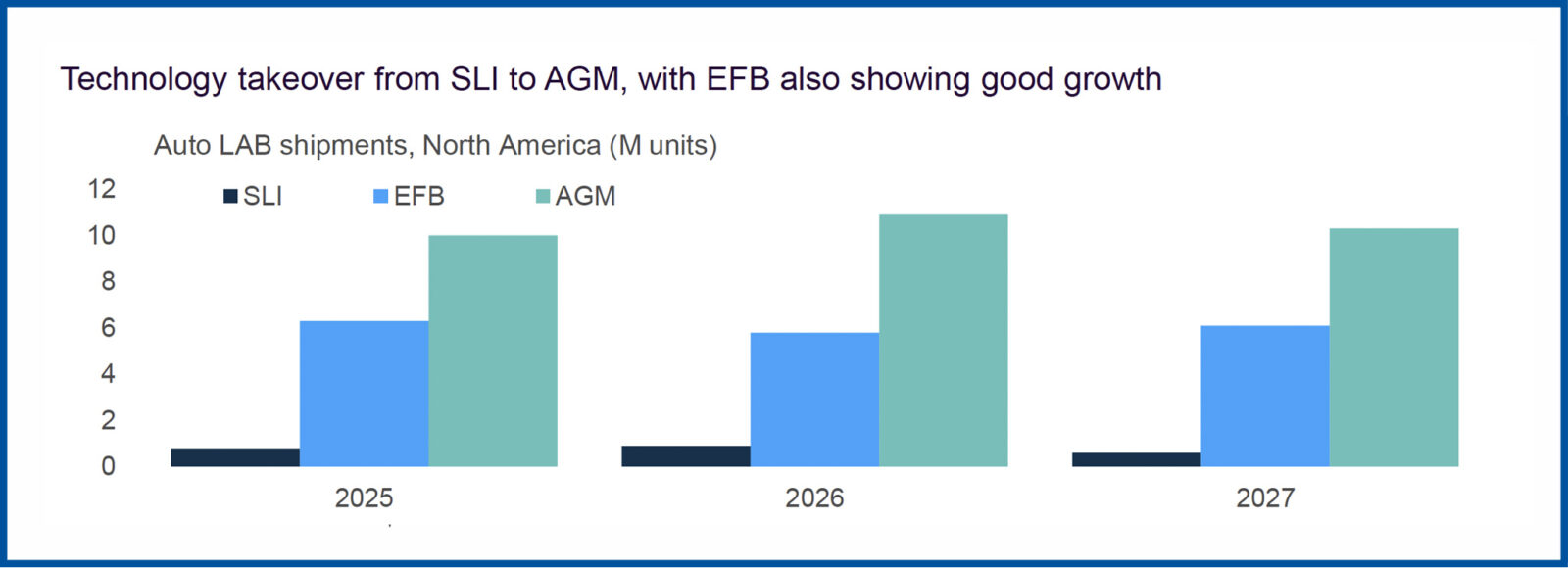

Beyond the broad trend of growth, the research by BCI and CRU also shows an evolving product mix that reflects the changing automotive fleet of North America – including strong demand for Absorbent Glass Mat (AGM) batteries and other advanced lead battery technology.

Automotive demand continues upward trajectory

The CRU report shows strong overall demand for automotive lead batteries within North America, despite the predicted slow-down in light vehicle production.

Key takeaways in the automotive market

- Automotive lead battery demand:

– Grew 3.9% year-over-year in 2024, continuing a gradual multi-year rise.

– 159M units shipped in 2024, which is up +3.6% (+5.5M units).

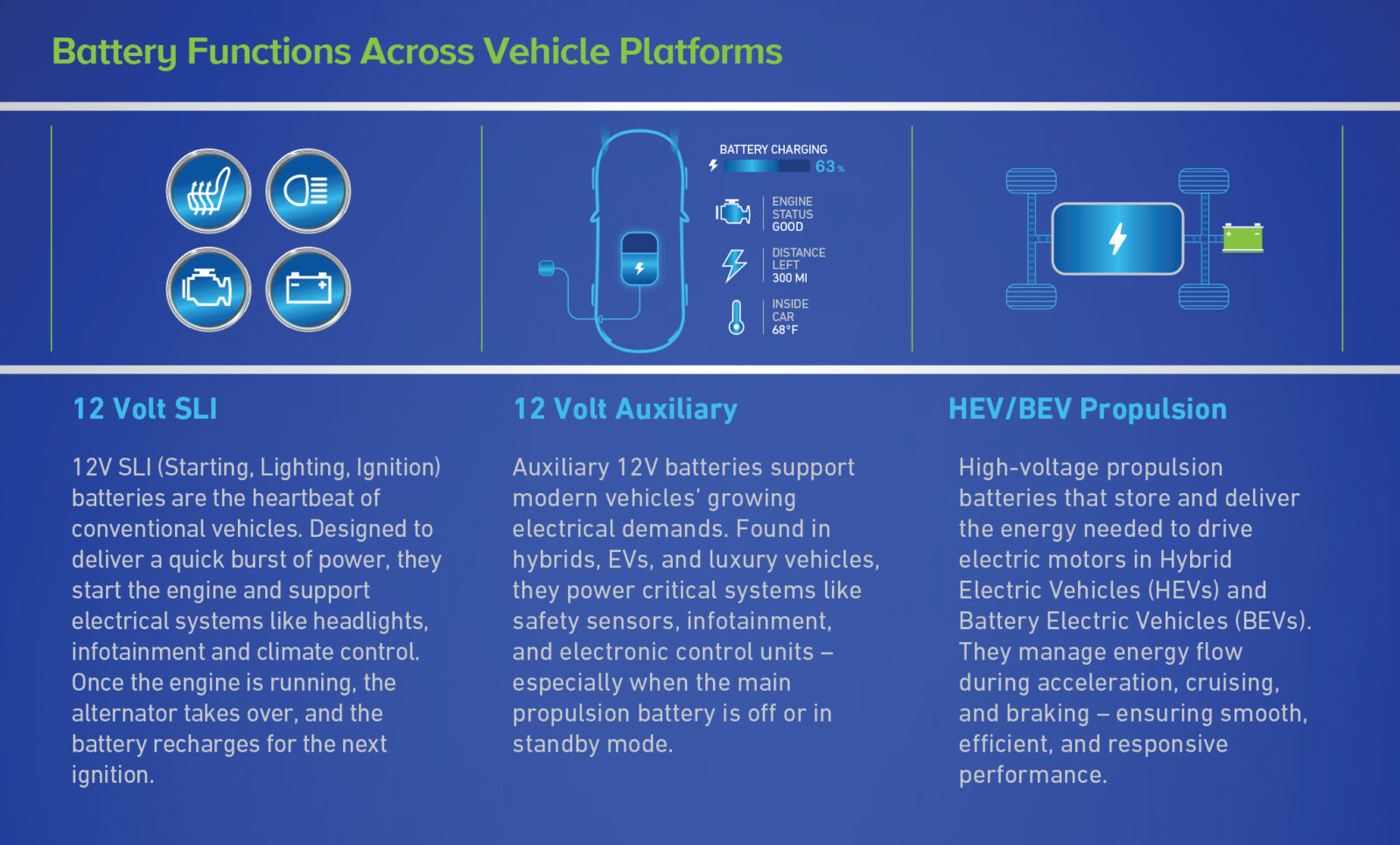

Though lithium-ion is the primary powertrain battery for EVs, lead batteries remain the primary auxiliary battery for the ubiquitous technology in today’s automotives.

- Lithium-ion-phosphate batteries (LFPs) in 12V systems grew dramatically:

– A five-fold year-over-year increase.

– 2.8M vehicles produced in 2024.

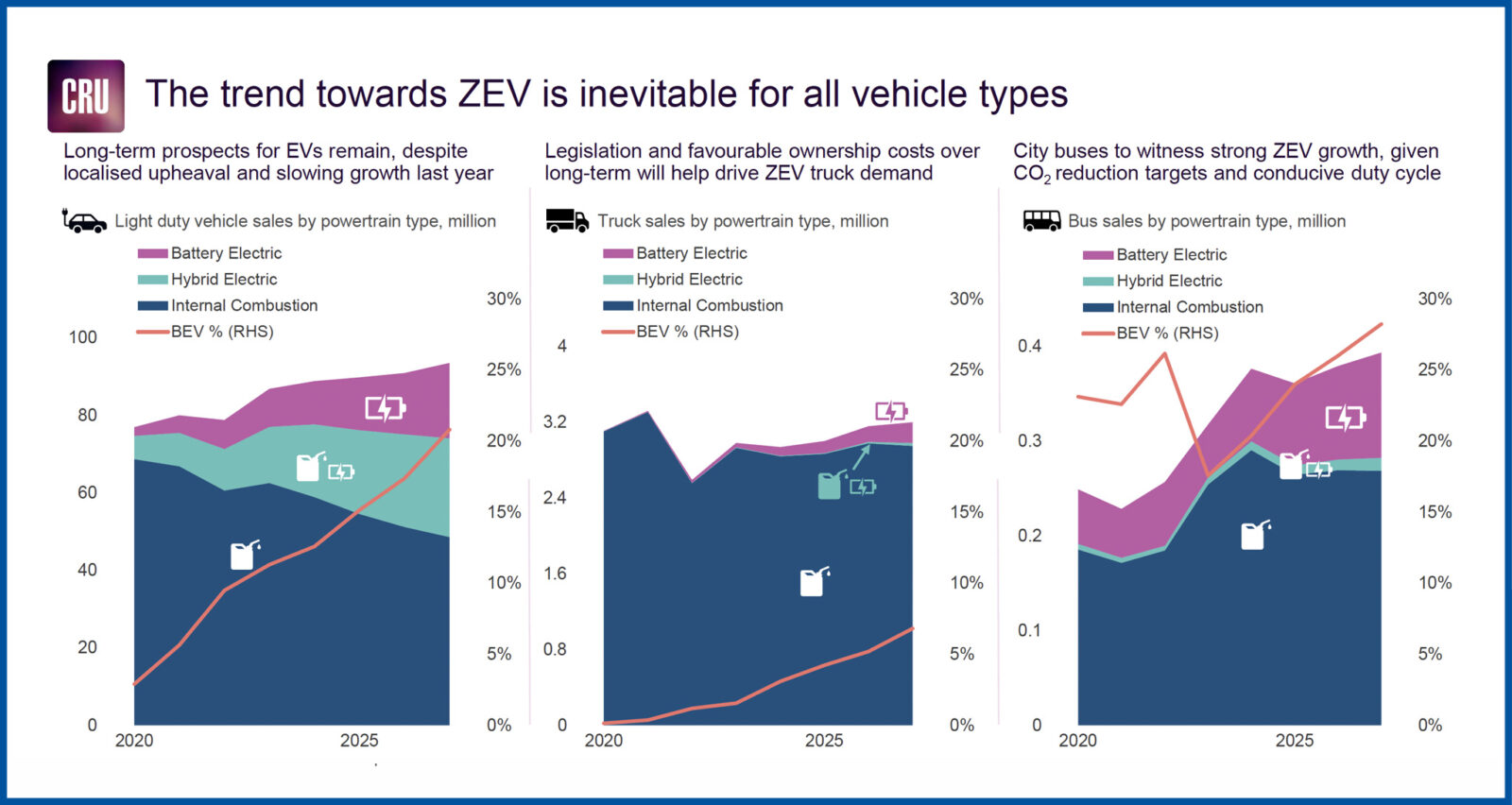

- Global light vehicle production is expected to increase a modest 0.4% in 2025 and 0.7% in 2026, dampened by readjustment of supply chains and stock drawdowns.

Replacement batteries drive lead growth

Lead batteries and their replacement continue to sustain and propel industry demand. The vehicle population is continually growing and aging, with vehicles lasting longer. The average age of light vehicles on U.S. roads today is over 12.5 years. The 2024 growth rate was the highest since the initial 2021 rebound of 5% year-over-year. 2024 growth was aided by micro start-stop hybrid electric vehicles (HEVs) entering their first replacement cycles.

Meanwhile, 2024 growth of 1.8% year-over-year in the smaller OE sector was notably slower than 2023’s 17.6% year-over-year. Experts attribute this to post-Covid reductions in vehicle production and consumer purchases.

“While advanced battery technologies including AGM and lithium are gaining share, legacy SLI lead batteries remain the majority of the market,” said Rebecca Conway, Vice President of U.S./Canada Marketing at Clarios. “Lead automotive batteries are expected to see consistent demand and modest growth in the years ahead, particularly in replacement applications. And while events like the pandemic and more recent trade disruptions can certainly influence short-term dynamics, the long-term sales trends of lead automotive batteries remains incredibly consistent.”

Lead battery technology shifts to AGM ‘takeover’

The report confirms a shift to multi-battery solutions to meet the power needs of vehicles across the powertrain spectrum. Within the automotive lead battery sector, there’s been strong growth in absorbent glass mat batteries (AGMs) and extended range flooded batteries (EFBs), but only small growth in starter, lighting and ignition batteries (SLIs).

From starting a vehicle engine to powering advanced safety features and high-voltage propulsion, each specific battery type serves a distinct function across automotive applications. All vehicles across the powertrain range require low 12V batteries to perform starter and auxiliary duties (e.g., safety, security), often using multiple batteries per vehicle.

“Different chemistries give you batteries with different qualities. Some typically run longer, some have higher power for a shorter period time, some are heavier, and some are impacted by the outside air temperature. No one chemistry is better than another when making batteries for vehicles, it really comes down to the application,” said Federico Morales-Zimmermann, Group Vice President and General Manager, Original Equipment & Technology at Clarios.

Automotive lead battery forecast: Modest growth, continued resilience

Overall growth for automotive lead batteries will continue at a modest pace: North American shipments are expected to grow by:

- 2.5% year-over-year in 2025

- 2.8% year-over-year in 2026

- 2.6% year-over-year in 2027

This is below the 3.2% year-over-year average of 2021-2024, again, attributed to the post-Covid catch-up boom. OE demand has eased as inventories normalized. Shipments have been slower 2025, after a mild winter and more sluggish vehicle supply path continuing from 2024.

Factors affecting automotive battery forecast

- Electric and Hybrid Vehicles The trend toward ZEVs is inevitable for all vehicle types. Despite a slower adoption pace, OEMs will continue to switch powertrain portfolios to a more flexible and wider portfolio of ‘stepping stone’ HEV offerings. CRU reports we’ll see less aggressive moves to BEVs.

- Newer battery technologies The pace in which EV manufacturers are using low-voltage, lithium-ion batteries is accelerating fast, despite representing only 4% of current vehicle production. This transition won’t impact lead battery business in the short-term; they’ll remain ‘king of auxiliary auto systems,’ whatever powertrain OEMs choose.

For more information on current data and future projections on the automotive battery market, contact media@batterycouncil.org.