Our guest blogger, John Howes, is the founder of Redland Energy Group where he has been a senior strategic advisor on energy policy and natural resources for nearly three decades. Below, he provides an overview of the Energy Storage 2030 report recently presented at DOE’s Energy Storage Grand Challenge Summit.

BCI Member Companies Partner with DOE National Laboratories to Advance Research

Lead batteries and other non-lithium technologies are worth the U.S. Department of Energy’s (DOE) time, effort and budget. That was a key conclusion shared in a new report issued by the DOE’s Office of Electricity (OE) at the Energy Storage Grand Challenge (ESGC) Summit held June 25–27, 2023, at Georgia Tech in Atlanta, Georgia.

The energy storage community united for the third annual event to explore clean energy pathways, including cost-effective battery innovation for renewable energy storage. The event is intended, in part, for stakeholders to inform how DOE will formulate strategies – and battery technology investment – to accelerate clean energy storage innovation and deployment over the next decade and beyond.

Several Battery Council International (BCI) member companies are already actively engaged in working with the DOE and its national laboratories throughout the U.S. to advance energy storage technology.

Achieving a 90% Drop in Per Kilowatt-Hour Cost

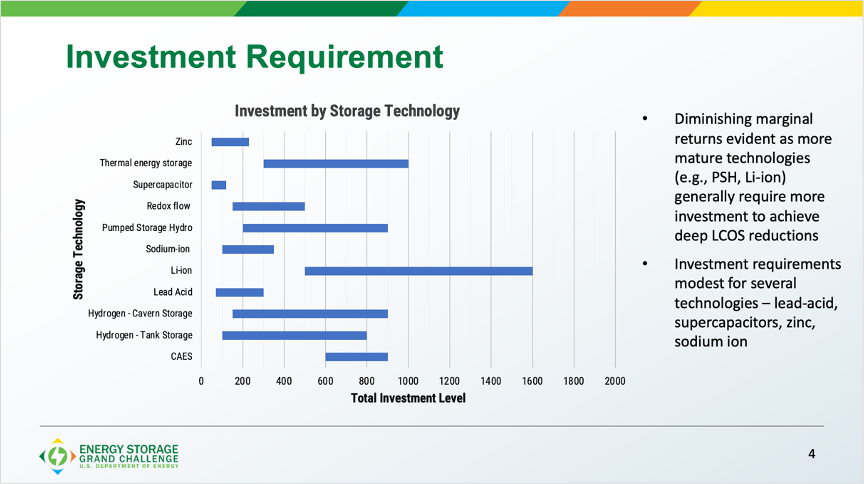

The DOE report said that if batteries and other energy storage technologies are to become cost-effective for utilities to use, their levelized price must drop by about 90% to $0.05/kWh. To assess the likelihood of that accomplishment, researchers analyzed 10 energy storage battery technologies.

Conclusions on Energy Storage Investment by Technology

- Research Funding Needs Vary by Technology. For lithium-ion batteries to become an economically viable resource to help integrate power from wind and solar facilities to the nation’s electric grid, more expensive research will be required. But other technologies, like lead batteries, can be equally viable with a considerably smaller research budget.

- Lithium-ion Batteries Investment Costs are Higher. More than $1 billion in new research over the next 8–13 years will be needed for lithium-ion to approach the price target

- Lead Batteries Investment Costs are Lower. Lead batteries could also approach that target with a budget one-fifth the size over 5–9 years.

Lead Batteries Better Positioned to Meet Target Energy Storage Goals

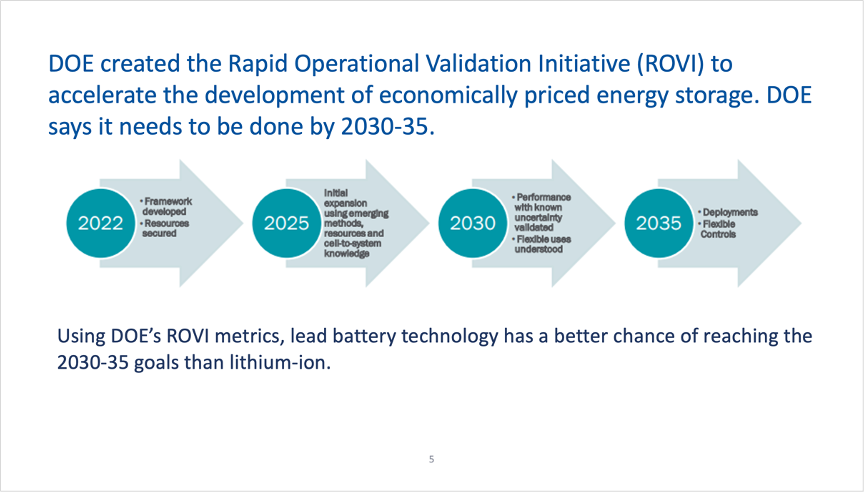

The DOE created the Rapid Operational Validation Initiative (ROVI) to accelerate the development of economically priced energy storage. DOE says it needs to be done by 2030-35.

The 5–9-year window is especially important, since DOE has prioritized a levelized cost of batteries and other storage technologies to the $0.05/kWh target by 2030-35. In addition to lead batteries, other storage technologies like zinc, sodium-ion and flow also could reach the price target with less expensive budgets than lithium-ion.

Renewable Energy Storage Needs Expose Flaws in Some Battery Chemistries

Throughout the past 10 years, the share of electric power generated by wind and solar technologies has grown dramatically, from five to nearly 20 percent. That increased presence of variable power is forcing utilities to store that power for when it’s most needed.

The storage technology used more commonly at present is pumped hydro. But that requires being located next to large bodies of water. Compressed air and geothermal also have geographic limitations. For storage technologies that can be placed anywhere, most recent public attention has focused on lithium-ion batteries, which have been manufactured and marketed primarily by producers from Japan, South Korea and China.

While lithium-ion batteries certainly work, utilities have grown frustrated by their high costs, and not just for the batteries themselves. The battery chemistry requires extensive safety mechanisms to guard against the risk of explosions resulting mostly from microscopic flaws (dendrites) in battery cells that cause short circuiting.

Among those utilities going public with their concerns about lithium-ion batteries is Duke Energy. At a June 7, 2023, meeting of the DOE’s Electricity Advisory Committee, Jason Handley, director of Duke’s distributed energy group said, “Non-lithium-based solutions, I believe, will be the key for us truly getting to where we want to go as an industry for providing storage and longer-term storage for our customers and for our communities.”

U.S. Must Invest Beyond Lithium-Ion Batteries

Most expect DOE to continue research into the technical issues of lithium-ion batteries. But Congress has directed DOE look beyond lithium-ion. In its July 17, 2021, report on the FY22 funding bill, the House Appropriations Energy and Water Development Subcommittee said, “The Committee recognizes the emergence of several new energy storage technologies that can support energy independence in the United States. The Committee directs the Department (DOE) to publish a report on emerging energy storage technologies.”

Following that directive from Congress, DOE began actively investigating technologies like hydrogen, pumped storage hydro, compressed air, supercapacitors, thermal units, and other battery technologies using sodium, zinc, flow and lead.

DOE Takes Closer Look at Lead Battery Solutions

The inclusion of lead batteries was somewhat surprising to some, who look at the technology as inexpensive, readily available, safe, functional and recyclable, but one that is old and does not last very long. The issue of how to improve the short cycle life of lead batteries brought North American lead battery producers together with several U.S. national laboratories. This work has caught the attention of DOE, which decided to include lead battery research into its ESGC program.

In the case of lead batteries, which have served as backup power for electric utilities, telecommunications, data centers and other stationary applications for many years, DOE researchers have begun identifying ways to unlock the underutilized potential of the batteries to improve their cycle life and energy density.

Investing to Unlock Full Potential of Lead Battery Technology

Last year, OE sponsored a lead battery technical advisory group (TAG) meeting at Argonne National Laboratory to identify specific research topics that could merit investment from DOE. Technology officers from virtually every North American lead battery manufacturer attended, along with several major supplier companies.

The result of the TAG meetings was a list of more than a dozen topics like redesigning current collectors, novel active materials, advanced manufacturing and demonstrations. From this list, OE scientists estimated a budget of nearly $200 million to be spent during the next 5 to 10 years to help improve the cycle life of lead batteries and get closer to DOE’s $0.05/kWh cost target.

The DOE report does not suggest reducing or even eliminating research on lithium-ion. Rather, DOE says research into lead and other non-lithium technologies is worth the time, effort and budget.

DOE Releases More Financing Opportunities

As a companion program to ROVI, DOE set up the ESGC and Long Duration Energy Storage programs. OE began a deep dive into its technology portfolio to examine a range of research initiatives. OE commissioned Argonne National Laboratory, Idaho National Laboratory, Pacific Northwest National Laboratory, Oak Ridge National Laboratory and Sandia National Laboratory to carry out the work. The purpose was not only to identify research initiatives, but also budget estimates.

That work culminated in the report that was unveiled at this year’s ESGC summit held. At that time, OE also has released two new funding opportunity announcements (FOAs) to attract from the private sector proposals to carry out new research under the DOE auspices.

More FOAs are expected in the coming months; all are aimed at helping strengthen North America’s energy storage industry to produce longer-lasting, economically priced storage technologies. These technologies not only will help electric utilities, but other sectors like telecommunications, data centers, health care, education, manufacturing and many others.

Lead Battery Industry Poised for Research, Partnerships

As the U.S. races to domestically meet its sustainable energy storage needs, BCI strongly believes that research is pivotal.

The lead battery industry recognizes the immense value of federal research and development funding. Furthermore, industry members are excited to pursue more partnerships with research institutions like DOE’s national laboratories and programs such as ESGC.