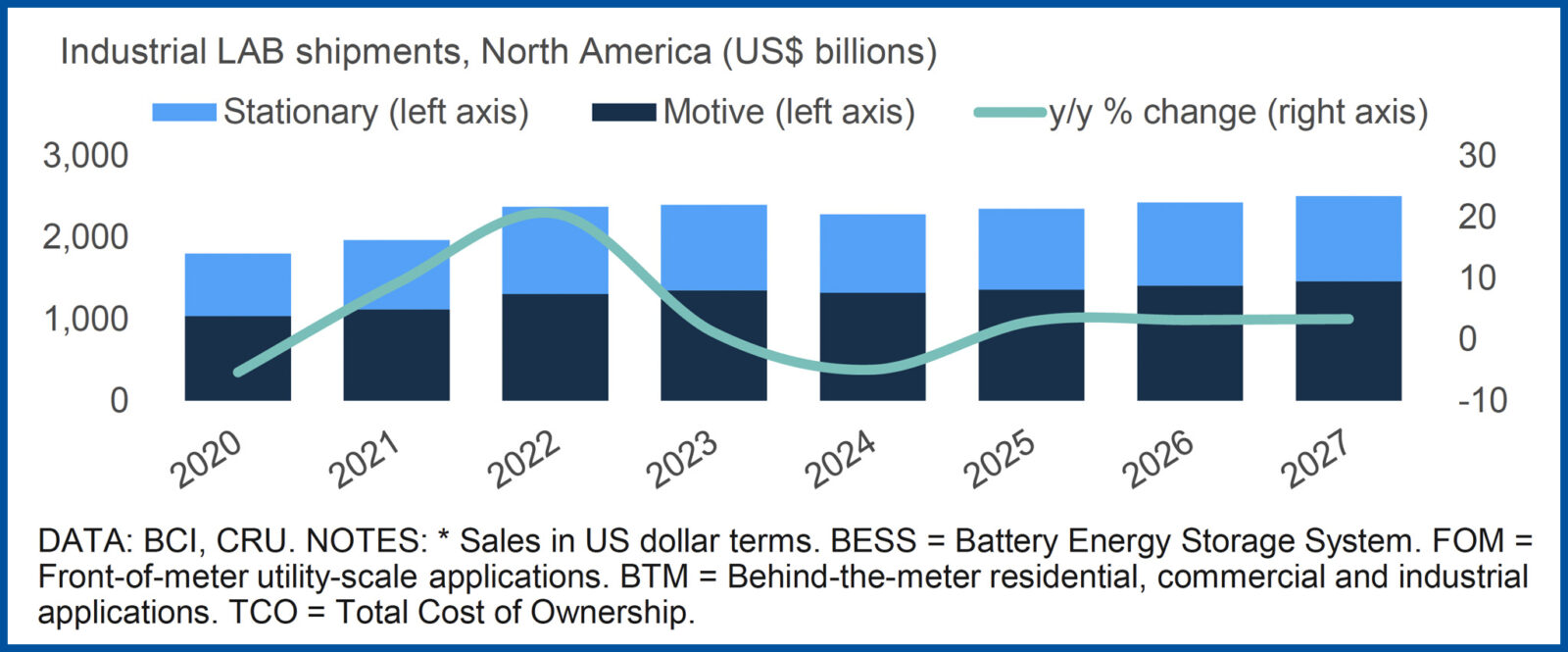

The outlook for the North American industrial lead battery market remains strong, with an annual growth rate of about 3% projected across motive and stationary applications through 2027. That’s according to a new report on battery market trends that combines exclusive data from Battery Council International with analysis by commodity research firm CRU.

Driving the optimism is a strong industrial stationary sector: lead batteries are essential for uninterruptible power supply (UPS) in data centers including those supporting AI. Growth also is expected for lead batteries that support telecommunications, complex grid demands, and other critical Battery Energy Storage Systems (BESS) applications. The report also forecasts 3.0% annual growth for industrial motive lead batteries through 2027.

Demand for industrial stationary energy storage stays steady

Stationary storage supported by lead batteries is forecasted to remain strong through 2030, especially as grids grapple with intermittent power supply and the proliferation of data centers.

Key takeaways in the industrial BESS market

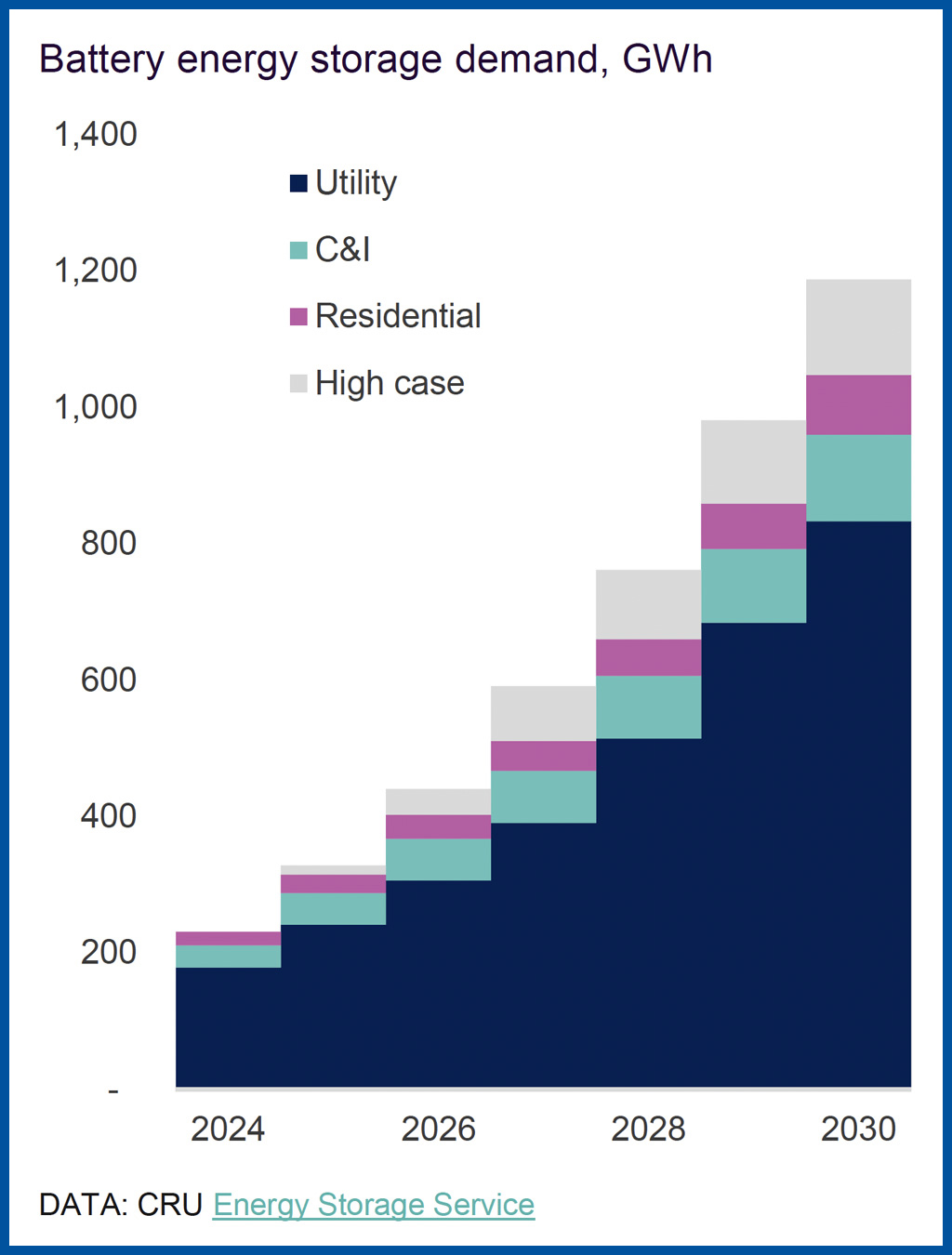

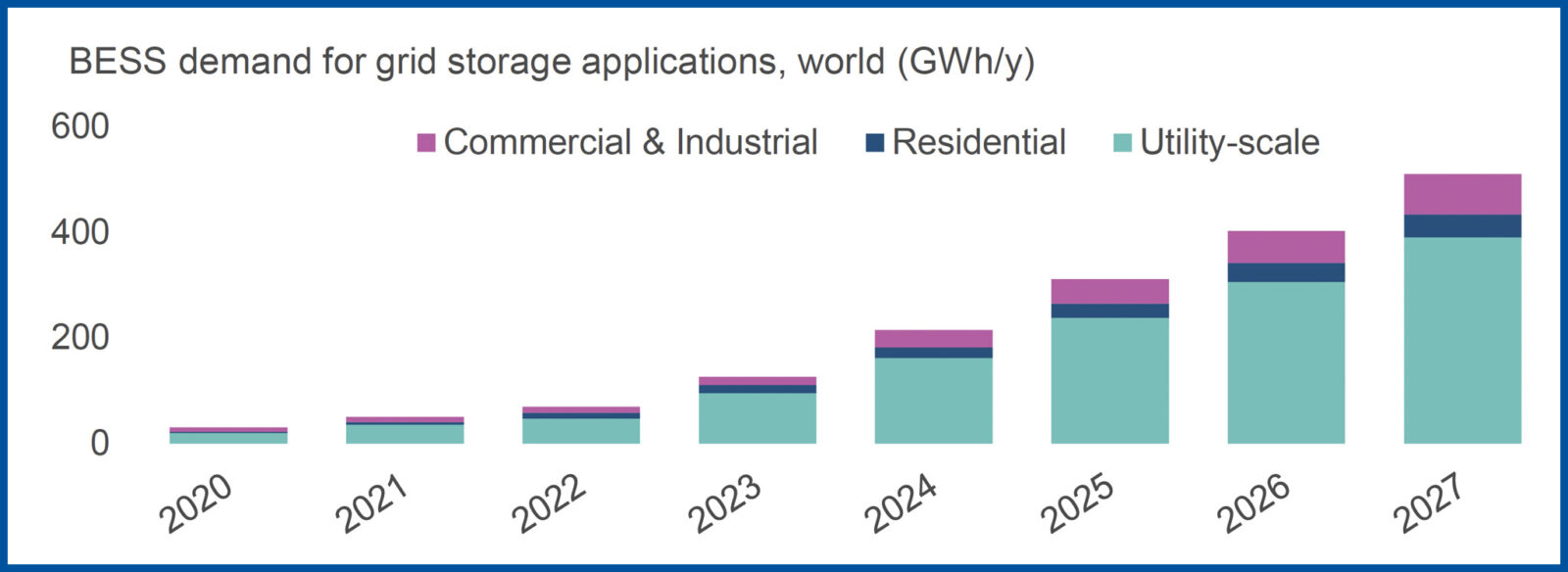

- Steady, proportional increases in BESS demand will continue in utility, commercial, industrial, and residential markets.

- Demand for battery energy storage will soar from roughly 200 total GWh in 2024 to 1,200 GWh by 2030.

Utility-scale use will drive the BESS boom. Grid storage applications are forecasted to more than double between 2024 and 2027.

The economics of power storage, arbitrage, and grid balancing services are primary drivers in energy storage growth. Globally, one third of installations last year were standalone, not directly connected to renewable power installations. This will remain a key market segment this decade, as grids deal with a growing share of intermittent supply.

Data centers are central to industrial UPS lead battery growth

The electricity requirements from new data centers are propelling battery demand. A major factor is the explosive growth of AI and the massive need for data processing. While other battery chemistries have some market share, lead batteries should see continued demand growth thanks to proven reliability, cost-effectiveness, and a high temperature tolerance that data centers require.

Industrial motive lead battery outlook is cautiously positive

On the industrial motive battery side, the outlook for lead looks positive:

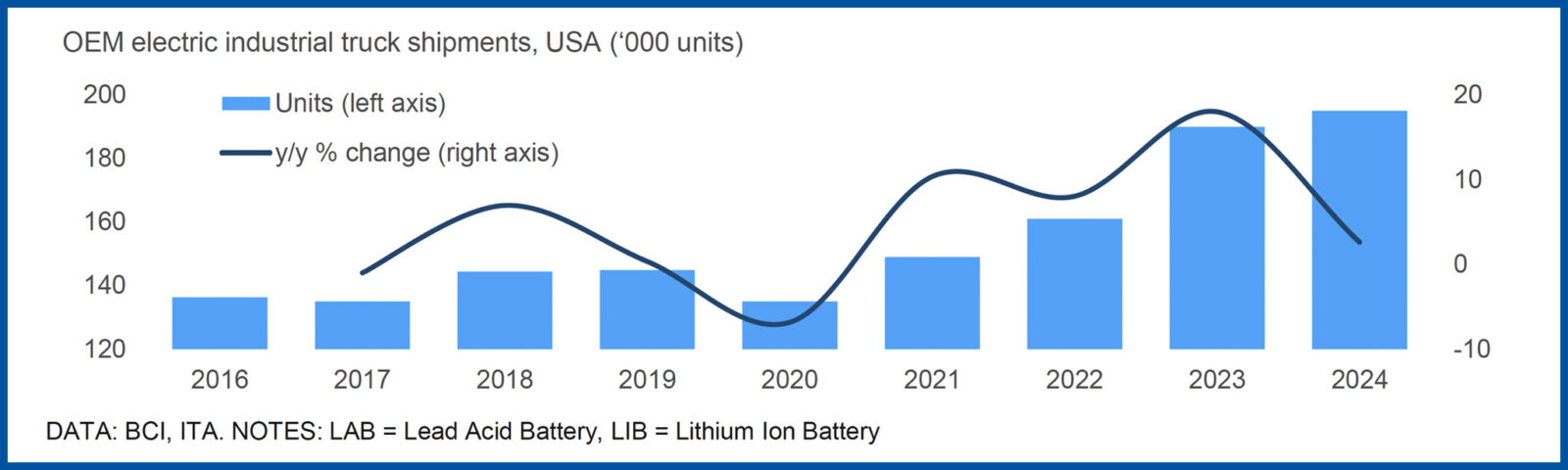

- OEM electric industrial truck shipments ticked slightly up in 2024.

- BCI members predict a 3.0% CAGR in lead battery sales out to 2027.

- Sales predictions through 2027: industrial trucks (+3.1%), mining (+2.8%) and railroads (+1.7%).

Within the motive market, lithium battery share growth appears to be slowing. Industrial truck OEMs’ focus is on maintenance-free, heavy-duty use, fast charging and long cycle life. Advanced lead batteries including Absorbent Glass Mat (AGM) technology are increasingly competitive with lithium, however.

Forecast for industrial lead battery market: modest, but steady

Overall growth for industrial lead batteries will continue at a modest pace.

Through 2027, BCI members predict North American industrial lead battery sales as:

- CAGR of approximately 3%.

- Stationary sales driven by UPS (+4.1%), with slower growth in telecoms (+1.7%).

- Solar photovoltaic (PV) sector will drive utility-scale BESS installations

- Motive sales driven by industrial trucks (+3.1%), mining (+2.8%) and railroads (+1.7%).

Factors affecting industrial lead battery growth

In utilities, opportunities will be driven by larger Front of the Meter (FOM) installations rather than smaller Behind the Meter (BTM) stationary energy storage applications. However, the effectiveness of lead batteries in BTM will continue to drive demand because of comparative safety benefits and lower cost for emerging markets than some alternatives.

For the industrial motive market, lead battery demand will be constrained by longer truck life, growing lithium-ion share, and higher lead battery imports. However, OEM electric forklift truck shipments were up 2.6% year-over-year.

For more information on current data and future projections on the automotive battery market, contact media@batterycouncil.org.