Clarios’ Rebecca Conway Presents at 2023 BCI Convention + Power Mart Expo

The transportation market is driving the battery industry’s steady growth, with no immediate detours in sight. That’s according to a recap of 2022 industry data presented by Rebecca Conway at the 2023 BCI Convention + Power Mart Expo. The annual event was held April 23–26 in Louisville, Kentucky.

Conway is executive director of marketing and technical services at Clarios, a global leader in energy storage solutions. Her presentation included a high-level review of the 2022 transportation market and a forecast for market performance 2023–2028.

Most Influential 2022 Market Factors

Overall, Conway said that 2022 was an “absolutely very strong year for our battery market,” based on data provided by Battery Council International (BCI) members. She shared key factors influencing that growth and shaping the dynamic future of battery technology:

- A growing and aging global car parc.

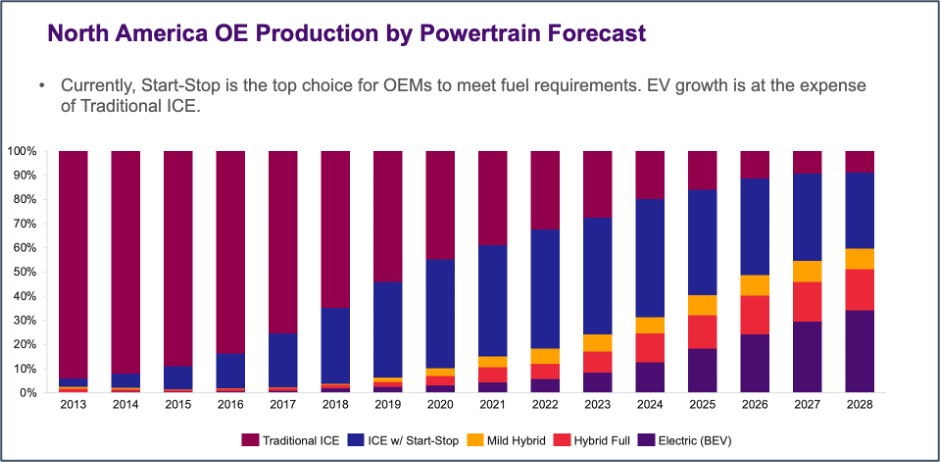

- OE production’s continued growth; start-stop will be the preferred powertrain for the next few years

- EVs will grow, albeit slowly and at the expense of traditional internal combustion engines.

Conway said that as the car parc continues its shift to start-stop, we will need more advanced batteries, specifically AGM (absorbent glass mat) batteries. [NOTE: Lead batteries are an AGM battery.]

Driving Habits Propelling Battery Demand

The popularity of driving hasn’t returned to pre-COVID-19 levels yet, but it’s making a comeback. Total miles driven last year were up 2.1% from 2021, according to the U.S. Department of Transportation.

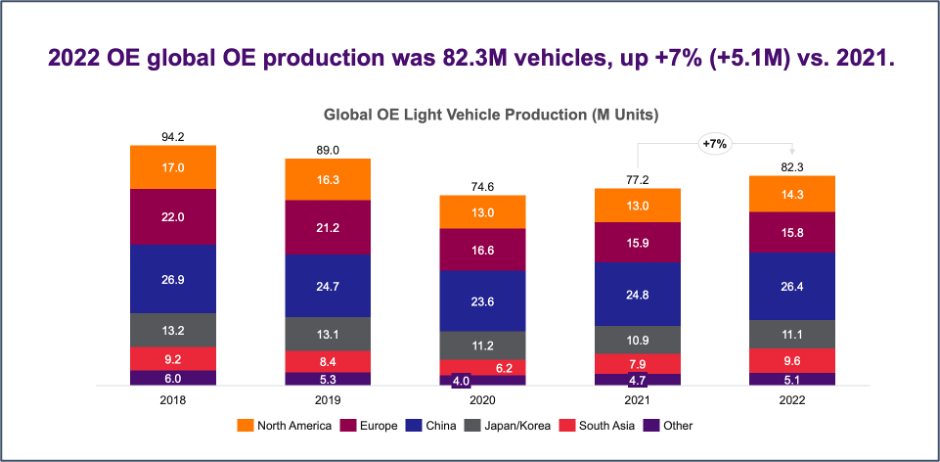

“Consumers are using their vehicles more than ever,” Conway said. “We’ve seen very strong consumer behavior.” That includes purchasing new vehicles. She said the biggest change since COVID has been original equipment (OE) production: 2022 OE global production was 82.3M vehicles, up over 5M since 2021 (+7%). Historically, the market is at 94M.

In addition:

- Overall industry demand for 2022 was 149M units, up 5.4M units (3.8.%), based on total North American shipments of OE and aftermarket (AFM). Demand has not returned to pre-COVID levels. “We have reached a new baseline for our industry” according to Conway.

- OE growth of 10%, driven by growth across all segments.

- Aftermarket increase of 3%, with growth across all segments except Marine. Automotive shipments were up 1.6%.

Marine and RV Segments Slowed

COVID had an enormous impact on how consumers spent their recreation time, often in the outdoors. While 2022 marine shipments were down 4%, there is significant growth since 2019. There are nearly 16M boats in active use.

Likewise, new recreation vehicle (RV) sales slowed in the second half of 2022, after hitting record sales in 2021.

About Heavy Duty Segment Growth (OE and AFM)

As Conway stated, Heavy Duty shipments were up 16% in 2022. This is on top of more than 10% growth in 2021.

Factors that impacted growth included a post-COVID-19 virus economic rebound, combined with fleets keeping trucks on the road longer – and thereby increasing replacement cycles.

A Growing and Aging Car Parc

Conway shared market projections for the next five years, based on battery units. A growing and aging car parc will continue to affect demand.

At the end of 2022, there were 282M light duty vehicles in operation in the U.S., up more than 16M million vehicles, compared to 2017. That represents about a 1.2% CAGR over the last five years. Experts forecast the car parc’s growth to slow to 1%, due to continued lower than historical OE sales and people holding on to their vehicles longer.

“The average age of cars on the road has reached 12.6 years, the oldest it has ever been. We expect that to continue, which means more opportunity for an aftermarket battery replacement.” [Fact: In 2002, average vehicle age was 9 years.]

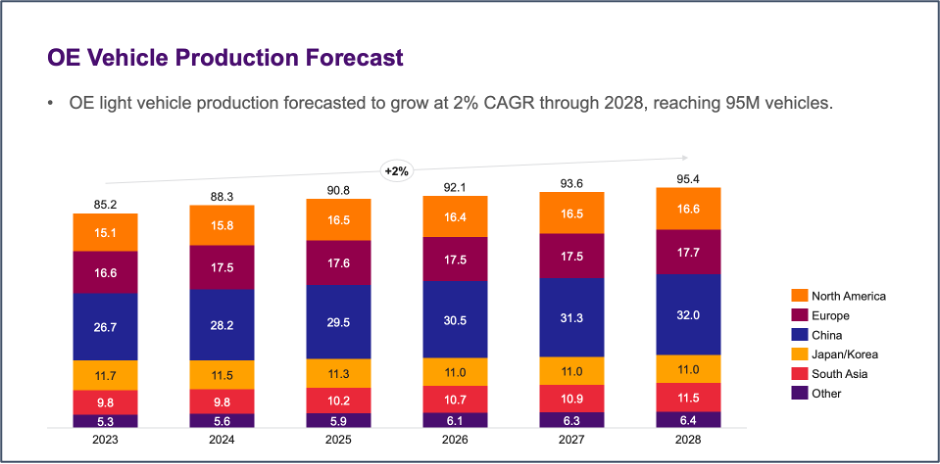

OE Vehicle Production Forecast

The global production of OE light vehicle production is forecasted to grow at 2% CAGR through 2028, reaching 95M vehicles.

Likewise, the battery shipment forecast looks strong. Data provided by BCI members showed a consensus of continued growth. North American findings included:

- Total market growth of about 1% CAGR through 2028 (OE at 1.8%; aftermarket at 0.9%).

- Segment growth of: 1.9 % for Heavy Duty; 1.5% for Golf Car; Marine at 1%, and .9% each for Auto, Lawn and Garden, and Powersports.

Emissions Reduction Mandates Continue to Shift Battery Technology Requirements

The need for OE manufacturers to meet emissions regulations is also keeping the battery industry busy. Start-stop is in about 50% of new vehicles being produced. Conway said it’s the number one choice for OE manufacturers to meet their emissions requirements.

“Increasingly, OEs choose AGM as the best option for start-stop vehicles. It’s designed to handle the load,” explained Conway. “It seems we all agree that AGM is really the future, and it’s absolutely going to continue to grow.” She said that AGM shipments reached 7.4M units in 2022, up 19% from 2019. Data provided by BCI members shows a consensus that AGM will continue to grow.

Battery Production by Powertrain: EV Adoption Remains Slow

While EV production is continuing to grow, actual hybrid/EV sales and registrations remain low. There are 10.3M hybrids/EVs in the U.S., which is up 23% vs. last year. Yet those vehicles account for less than 4% of the total light duty car parc (nearly half are in California, per Conway).

Multiple Batteries Needed

Conway also explained why new transportation technology and the shift in powertrain preference matters to the entire battery industry.

“We continue to see an increase in vehicles that require more than one battery. That’s good news for the industry, from a battery replacement perspective. More batteries offer greater a opportunity for us all.”