Stationary storage including UPS and BESS enable digital growth, grid resilience and national security

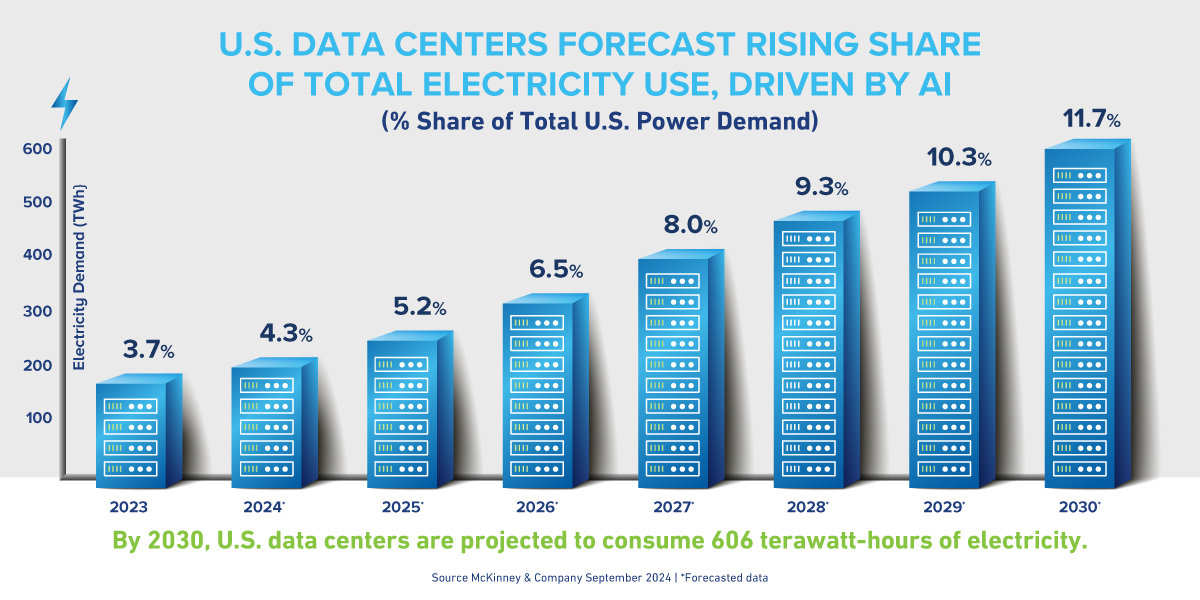

Artificial intelligence (AI), hyperscale data centers, and digital infrastructure are transforming the U.S. economy. They’re also driving unprecedented electricity demand. Experts predict consumption by U.S. data centers alone to quadruple between 2023 and 2030.

Two battery stationary energy storage solutions are helping meet this challenge: Uninterruptible Power Supply (UPS) and Battery Energy Storage Systems (BESS).

Together, they are ensuring reliability and scalability across the entire energy ecosystem. In doing so, they’re safeguarding critical operations, stabilizing the grid and supporting economic growth.

Defining UPS and BESS

UPS and BESS are proving just how essential it is to invest in domestic battery manufacturing and energy infrastructure to keep pace with demand and strengthen national security. Here’s more on each type of stationary energy storage:

- Uninterruptible Power Supply (UPS): Provides immediate, short-term backup power to critical systems such as data centers, telecom networks, and emergency services.

- Battery Energy Storage Systems (BESS): Offers scalable, long-duration energy storage for grid support, industrial operations and residential backup. Key functions include peak shaving, frequency regulation, microgrids, and backup power.

UPS: The backbone of AI and digital infrastructure

The rise of AI and hyperscale data centers have made UPS systems indispensable. These facilities require 24-7 uptime and power quality to ensure operational continuity for AI workloads and cloud services. The demand and critical need for batteries is growing:

- U.S. data centers consumed <200 TWh (tera-watt hours) in 2023, with consumption projected to reach 400–600 TWh by 2030.

- Data center power demand is forecast to grow at a 15% CAGR from 2023–2030.

- UPS is critical for digital infrastructure resilience. Even a brief outage could disrupt AI training cycles, cloud services and essential digital operations. That could debilitate everything from the healthcare industry to national defense.

BESS: Enabling grid stability and electrification

BESS provides long-duration storage to balance electrical supply and demand, integrate distributed energy resources, and enhance grid resilience.

- Global BESS market projected to grow from $76.7B in 2025 to $172.2B by 2030.

- Installed capacity expected to rise from 200 GWh (giga-watt hours) to 1,200 GWh. For context:

- One GW can provide enough energy for 300,000 to 750,000 households for one year.

- One large data center can require as much as 1 GW of power to operate.

- Installed capacity expected to rise from 200 GWh (giga-watt hours) to 1,200 GWh. For context:

As electrification accelerates and renewable penetration grows, BESS ensure the grid can handle variability and maintain stability, from manufacturing to military bases.

Stationary energy storage market growth, trends

Together, UPS and BESS form the foundation of a secure, modern energy system:

- Data center demand is expected to quadruple by 2030, driven by AI and cloud computing.

- BESS growth enables this demand by providing grid flexibility and resilience.

Key applications of battery stationary energy storage:

|

|

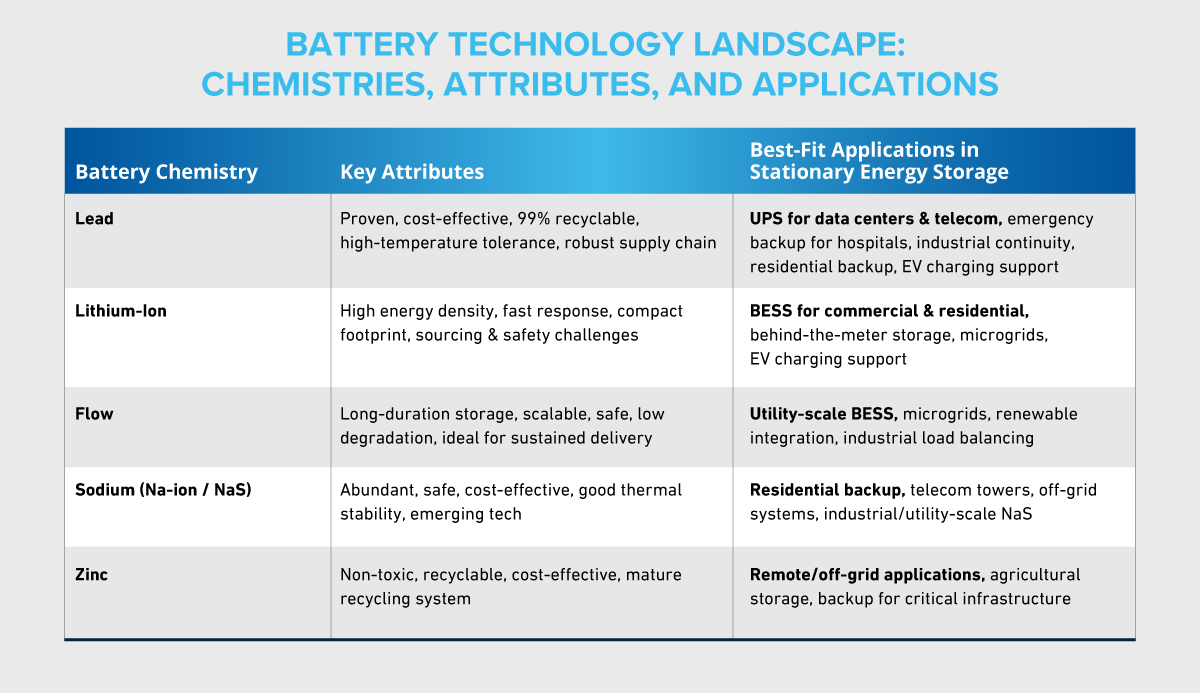

Demand requires multiple battery chemistries

Stationery energy storage is critical for our country; investing in domestic battery manufacturing and infrastructure is not optional. It is a strategic imperative to ensure energy security, economic stability and technological leadership.

It’s also why a host of battery chemistries – each with unique attributes – are necessary to meet the expanding list of applications.

Building a resilient, electrified future

Stationary energy storage is far more than a renewable integration tool. It is the backbone of the digital economy and a critical enabler of national security and economic growth. As AI and data centers accelerate electricity demand, and as electrification reshapes the economy, UPS and BESS systems will determine the resilience and competitiveness of the U.S. energy system.

Sources:

- Visual Capitalist / McKinsey – Charted: The Energy Demand of U.S. Data Centers (2023–2030P)

- Goldman Sachs, AI, data centers and the coming US power demand surge, April 2024

- Modor Intelligence, Battery Energy Storage System Market Size – Growth Trends and Forecasts (2025-2030)

- CRU / Battery Council International (BCI) – Industrial Lead Battery Market Outlook, October 2025