Investment in domestic infrastructure is essential to reduce dependence on foreign materials

A secure battery supply chain is essential for both national security and a robust economy. Starter batteries are used in tractors, airplanes, helicopters, submarines, boats, tanks, howitzers, and every vehicle on the road in the United States.

The North American (United States, Mexico, and Canada) battery industry is thriving, producing more than 160 million batteries annually and supporting more than 106,000 jobs. The downstream impact is even more substantial, with $10 trillion in U.S. economic output related to or reliant on battery technology.

Amid this backdrop of innovation and success, however, there remains a major concern for the energy storage industry — uncertainty around materials supply chains.

The North American starter battery industry built one of the most successful circular economies for any product on the planet. Though long acting as a bulwark against supply chain disruption, unfair competition from subsidized and low-quality producers now threatens the industry’s ability to expand domestic critical minerals capacity.

These battery materials are vital to meeting the growing demands of North American energy storage production, as well as national security and economic growth. That’s why Battery Council International (BCI) is urging a comprehensive effort to secure supply chains for battery materials that support national interests, in 2026 and beyond.

A Circular Battery Supply Chain Can Support Growth and Stability

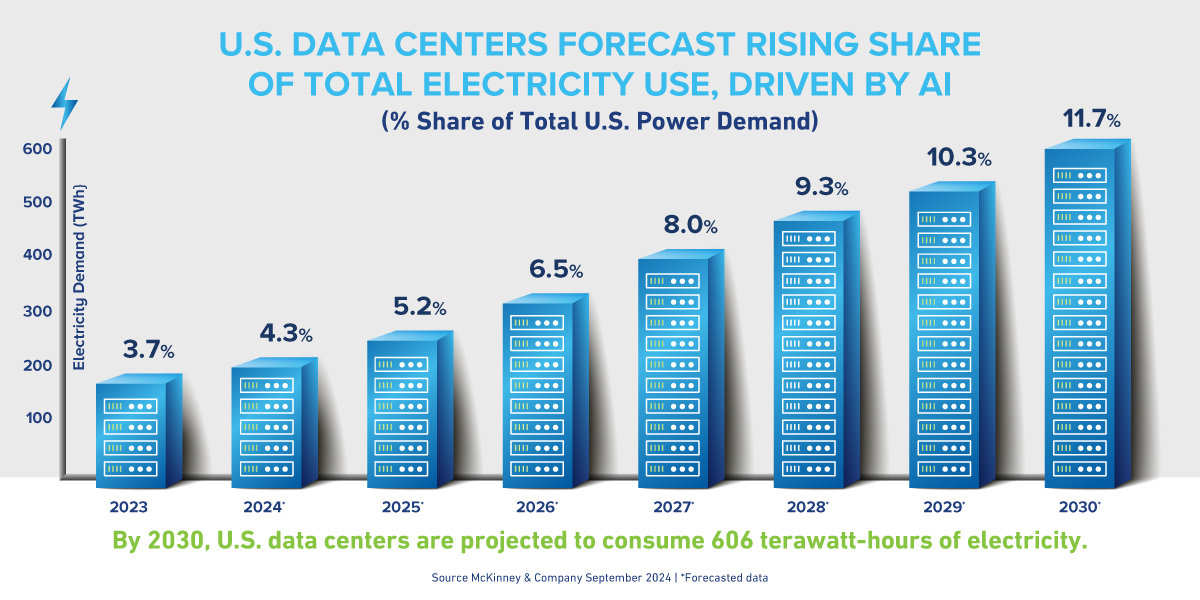

Domestic battery manufacturers are scaling up to meet projected demand growth for both existing applications and new opportunities that include powering artificial intelligence data centers and next-gen transportation technology. But the first link in the battery supply chain involves raw materials, and this area requires urgent attention.

Due to the circular economy that has been developed in North America, a significant portion of the raw materials needed to produce these batteries can be sourced within the region — but, importantly, not all of them.

At present, North America does not have sufficient capacity to recycle the full inventory of spent batteries. As a result, not only can North America not use those recycled materials to produce new batteries domestically, it means the critical materials contained within those batteries are being taken out of the region and sometimes sent to foreign adversaries.

Some American recyclers are working hard to find solutions, and have announced plans to expand capacity. But simple economics makes further investments uncertain. Unfair competition fueled by foreign government subsidies has created demand for our scrap batteries, sapping these critical materials and hurting domestic recyclers.

This challenge is not new, either. There has not been a new battery recycling center built in the United States since 2009 in large part to permitting red tape and misconceptions about local impacts. At the same time, primary lead smelters as well as secondary lead recyclers have both declined, with a total of nine facility closures between 1990 and 2021.

Opposition to the construction of modern, safe, and best-in-class recycling facilities has held back the world’s most successful circular economy and even enabled proliferation of sub-standard, illegal, and informal recycling operations in low- and middle-income countries. It’s up to policymakers to correct this dynamic, and provide battery recyclers the financial and regulatory certainty they need to justify continued investments in capacity expansion.

Increased capacity is in everyone’s interest. BCI data shows that the need for lead in battery production continues to increase at a 2% projected growth rate through 2027. What’s more, AI and data center growth and the need for backup power will create exponential demand in the long term, building demand on top of the current projections.

It all adds up to a battery materials supply chain under stress at a time of peak demand, and therefore an urgent need for investment and regulatory support.

Supporting Domestic Recycling Supports Everyone

Existing recyclers are doing their best to expand, despite current constraints. Recent progress for the U.S. energy industry includes a renewed permit for Ecobat’s City of Industry facility in California. Additionally, integrated battery manufacturer Clarios has unveiled comprehensive supply chains upgrades that includes $6 billion in total U.S. investments to increase domestic battery production and critical minerals recycling and processing.

When BCI meets with policymakers, they always applaud our industry’s efforts. No one believes it is proper for North American-made batteries to be recycled at sub-standard, illegal, informal recycling operations in low- and middle-income countries. Furthermore, everyone would prefer these good-paying jobs are remain here and are protected. Data shows North American battery recycling employees earn an impressive average annual income of $119,700 per employee.

For their part, North American battery manufacturers have a strong preference for sourcing materials from trusted suppliers within the region or other allied regions that share our values, rather than doing business with opaque international brokers.

The best way to protect the U.S. economy and our national energy security interests – is to ensure North American recyclers can fairly compete and provide manufacturers with the materials they need. That includes ensuring that sufficient critical minerals stay onshore and preventing improper exports.

Building on Past Success to Power a Domestic Battery Revolution

On balance, 2025 was a year of progress for the North American energy storage industry. The U.S. Geological Survey designated lead as a critical mineral for the first time. This was an overdue recognition of lead’s foundational role in the American economy as the primary raw material in batteries that power nearly all cars and trucks on U.S. roadways, among many other important applications. Additionally, thanks in large part to the 45X advanced manufacturing credits, BCI members have already announced, deployed, or planned more than $7.5 billion in capital expenditures to increase onshore manufacturing and fend off unfair foreign competition.

Without supporting the circular domestic supply chain for raw materials can accentuate an even greater imbalance between demand and supply.

Without action, manufacturers will continue to be dependent on critical minerals from outside North America – even as foreign actors continue to extract these critical minerals from the region and export them. That creates supply chain risks for batteries that start millions of cars and trucks, but also support communication infrastructure, power military vehicles, provide backup power to life-saving systems at hospitals, and much more.

Resolving a systemic issue like the battery materials supply chain won’t be easy. It will require open dialogue, decisions based on real-world data, and a long-term commitment to shared solutions. But at BCI, we believe this is a problem we can all solve together.

Investing in domestic supply chains for critical battery materials is long overdue. North America’s economic future and national security depend on it.