Data Shows Continued Growth for Motive Power and Stationary Battery Solutions

The industrial lead battery sector has great news to share. Despite distortion from market dynamics and inflation, sales continue to grow. But challenges exist. The industry must capitalize on the market demands of today, while innovating for future needs in the booming energy storage sector.

That was a key message shared by battery expert Nick Starita during his presentation at the annual 2023 BCI Convention + Power Mart Expo held April 23–26 in Louisville, Kentucky. Starita is president of the Energy Solutions Division at Hollingsworth & Vose, a global manufacturer of advanced materials used in filtration, battery and industrial applications.

His presentation included a high-level review of 2022 market data, followed by market trends and forecasts based on data provided by Battery Council International (BCI) members. Starita also touched on the phenomenal growth ahead for energy storage systems (ESS or “the Grid Market”).

A Wealth of Information on Industrial Lead Batteries

His presentation, “North American Industrial Battery Market Forecast ‘23–’25,” provided an overview of the two distinct industrial lead battery market sectors: motive power batteries – also known as traction batteries – and stationary batteries, which are used for standby power, also defined as emergency power.

For motive power, he segmented lead batteries by their use in mining, railroad, and industrial trucks (primarily lead batteries in electric forklifts). Stationary battery data was segmented into miscellaneous standby, uninterruptable power supply (UPS), control and switchgear, and communications.

Overview of 2022 Motive Power: OEM Electric Forklift Shipments Soar

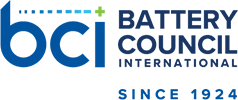

Starita reported that the Industrial Truck Market is currently 96% of the Motive Power Market, with BCI members accounting for 85-90% of lead batteries in this market. A motive battery powers the motor that drives an electric vehicle, such as a forklift truck and its lift, as well as powering accessories like headlights and other safety features.

Data shows North American motive power sales increased 16% in 2022 (up to over $1.2B), with a CAGR of 3% since 2015. Other statistics reported by Starita include:

- Industrial trucks accounted for about 15% of the sales increase.

- Motive power battery units decreased 4% in 2022, with some market distortion.

- Of total North American industrial truck battery volume (225K units), 88% were in the U.S.

- U.S. OEM electric industrial truck shipments were up 8% in 2022 – another record year, with a CAGR of about 4% between 2015-2022.

Starita elaborated on why battery units are down if industrial electric truck shipments are increasing at record pace. A big part is more sales of lithium batteries, which are well-suited for narrow-aisle, high/frequent-lift, indoor applications.

“There was really no lithium share back in 2012. Now, trucks that have lithium batteries represent about 5-8% share,” Starita said. “Nevertheless, as long as there is a healthy market for electric lift trucks, that’s certainly a good thing.” The opportunity for lead and different technologies, he added, is motive power electrification.

Features of the Ideal Motive Power Battery

When it comes to motive power batteries, Starita said users want batteries that can maximize productivity by increasing truck uptime. He described the “unicorn” industrial truck battery as:

- Maintenance free

- Long cycle life

- Highly durable

- Recyclable

- Cost competitive

2022–2025 Forecast for Motive Power: Over $1B

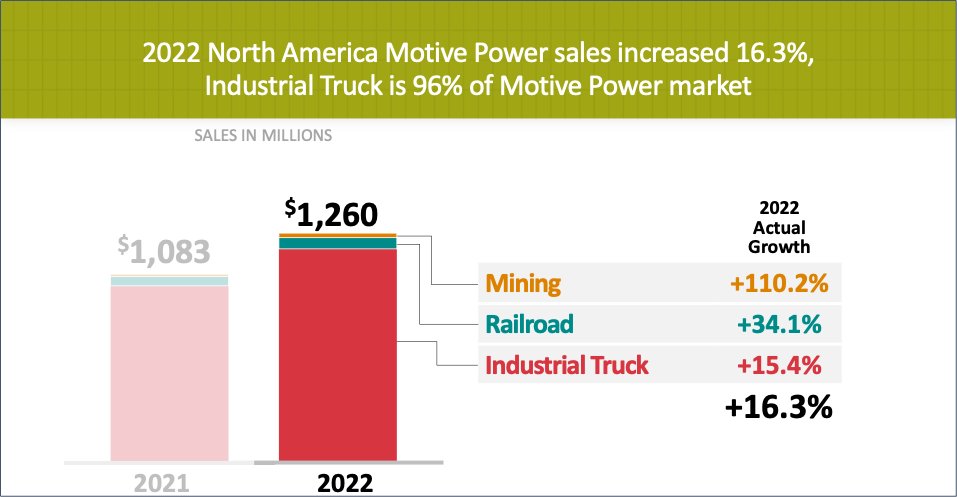

BCI members are predicting a median forecast of 6.2% CAGR for motive power, bringing the total market to about $1.5 billion by 2025. Data shows 8% growth in 2023, then 5% and 3.5% in the next two years. Increases will occur in all three market segments: industrial truck, rail, and mining.

Overview of 2022 Stationary Power in North America: Telecom Surges

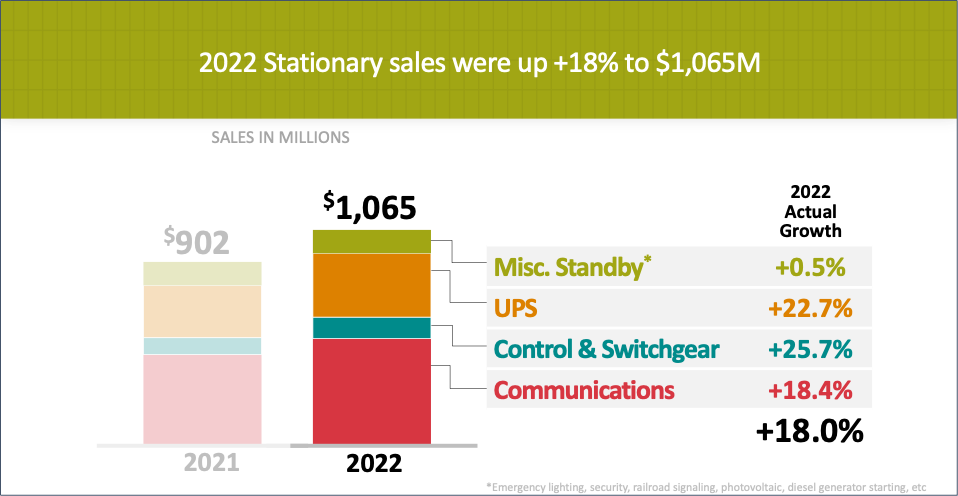

According to BCI members, 2022 was another strong year for the Stationary Battery Power Market, with sales up 18% ($1.065M). BCI members account for 85% market share for a sector segmented by:

- Control & Switchgear (mostly utility applications) – sales up 26%

- UPS (uninterruptable power supply to bridge gaps during outages) – sales up 23%

- Communications (also known as Telecom) – sales up 18%

- Miscellaneous Standby (emergency lighting, microgrids, etc.) – sales up .5%

Communications rose due to several factors converging:

- More investment at macro sites to support 5G data traffic

- Growth in wireless and wireline

- Renewed focus on network reliability and resiliency

- Replacement market continues to be strong

The demand for high temperature-tolerant batteries continues, with opportunities for lead and other chemistries. Major carriers are still risk-averse to lithium.

Data Center Application Growth

The UPS segment – of which data centers are the primary application – has been a harder market for domestic BCI members. BCI members have 65–70% market share in the UPS segment.

“The market is going to be really tough for domestic lead battery industry, due to lithium growth, especially in new data centers,” Starita said.

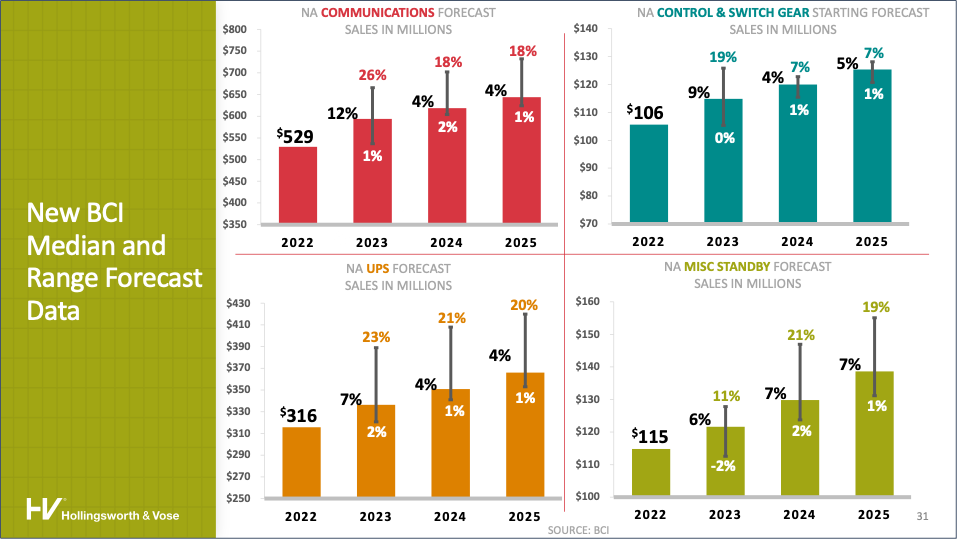

2023–2025 Forecast for Stationary Market

BCI members’ 2023–2025 forecasted stationary battery sales growth is 6% annually. Historically, it’s at about 3% per year. Communications will grow the most, at nearly 7%.

Energy Storage Systems (ESS) Market: $30 Billion by 2030!

Starita also gave a quick overview of the huge ESS Market (which includes renewable energy storage), driven by federal programming and EV charging. ESS sales approached $11M in 2022. However, he said the question remains, “How does the lead [battery] industry balance strong sales in today’s market while investing in future markets?”

More Lead Battery Innovation Required

The North American industrial battery market is more than $2.3B, with BCI members’ forecasting a CAGR of 5.7% between 2022–2025 ($2.7B). But a lot of new growth is being captured by alternative technologies, according to Starita. He said the lead battery industry must solve how to make enough batteries to capitalize on the opportunities of today and take advantages of the ESS opportunity. It will require innovation.

“We’ve got … to figure out how to do both. It’s about focus, resources and communications,” Starita concluded.