Growth in lead battery demand coupled with lack of metal production

The North American lead battery industry is thriving. However, a deficit in locally available materials has created a need for manufacturers to rely on overseas imports to meet the region’s growing demand and creating supply chain risks for the U.S. economy.

In fact, the U.S. Geological Survey recently proposed adding lead to the list of Critical Minerals because of its importance to national security and American businesses.

BCI has strongly supported this designation of lead as a critical mineral through five years of advocacy on behalf of its members. Protecting domestic lead supply is a vital part of supporting future economic growth and success.

More than 150 million lead batteries are produced every year in the U.S., according to BCI data, and recent analysis shows that number continues to rise. Commodity research firm CRU estimates a 2.5% growth forecast for automotive lead battery demand in the region through the remainder of 2025, which accelerates to 2.8% growth in 2026.

The vast majority of these batteries can be made in America with locally sourced materials, supported by an efficient and effective closed-loop recycling system across North America. The lead used in battery manufacturing can be infinitely recycled with no loss of performance, and a tremendous 99% recycling rate for spent lead batteries ensures a robust domestic supply chain powered by North America’s battery recyclers.

This network includes dedicated recyclers such as Ecobat and Gopher Resource, as well as manufacturers like East Penn Manufacturing, Clarios, and Stryten Energy that operate their own internal battery recycling facilities to fuel future production needs.

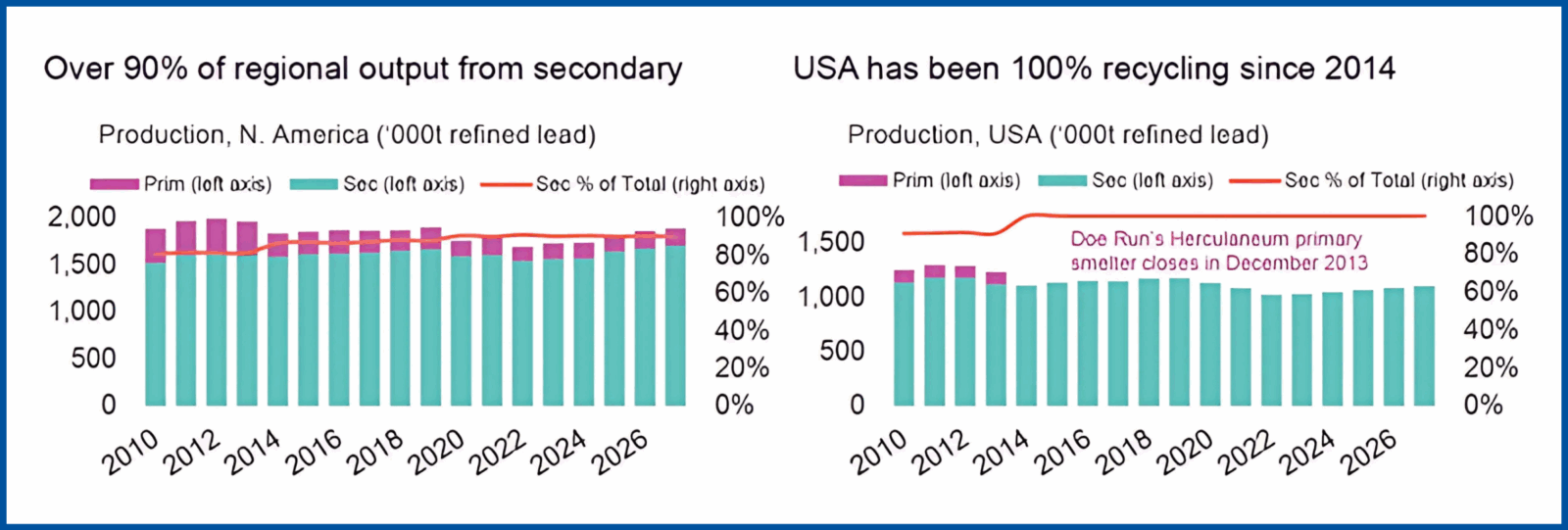

This stream of “secondary” lead generated from recycling – as opposed to “primary” lead extracted from the earth – is the foundation of North American battery production. However, it cannot cover the full needs of lead battery manufacturers.

Steady long-term growth naturally means the lead from last year’s batteries will not cover this year’s demand. Furthermore, it is not currently possible for U.S.-based recyclers to process 100% of spent U.S. batteries. While legacy facilities have done their best to improve and provide incremental increases in efficiency and capacity, there has not been a new battery smelter built in the United States since 2009.

At the same time, primary lead smelters as well as secondary lead recyclers have both declined with a total of nine facility closures between 1990 and 2021.

By comparison, U.S. battery production has roughly doubled in the same period.

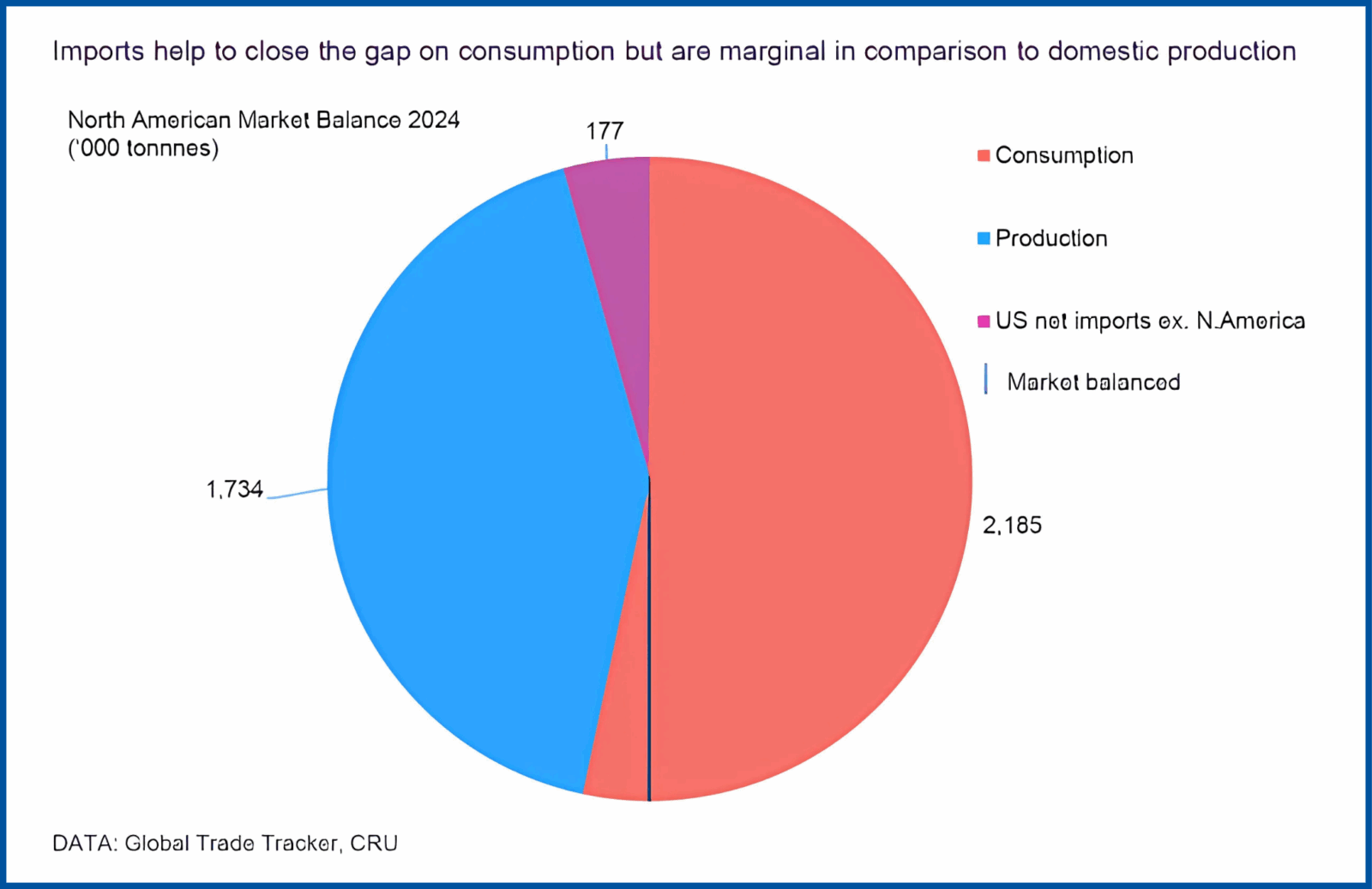

The end result is that the North American battery market currently sources about 90% of lead from domestic sources. The remaining 10%, or roughly 177,000 metric tonnes of lead, must be imported from elsewhere in the world to meet energy storage demand.

“There are many reasons why battery recycling capacity and lead production has not kept up with the growth in domestic battery manufacturing, including unique regulatory challenges as well as commercial concerns,” said Jordan Geist, Vice President of the Metals Division at East Penn Manufacturing. “That said, battery recyclers and lead producers understand the urgent need to protect U.S. supply chains and support the nation’s future demand.”

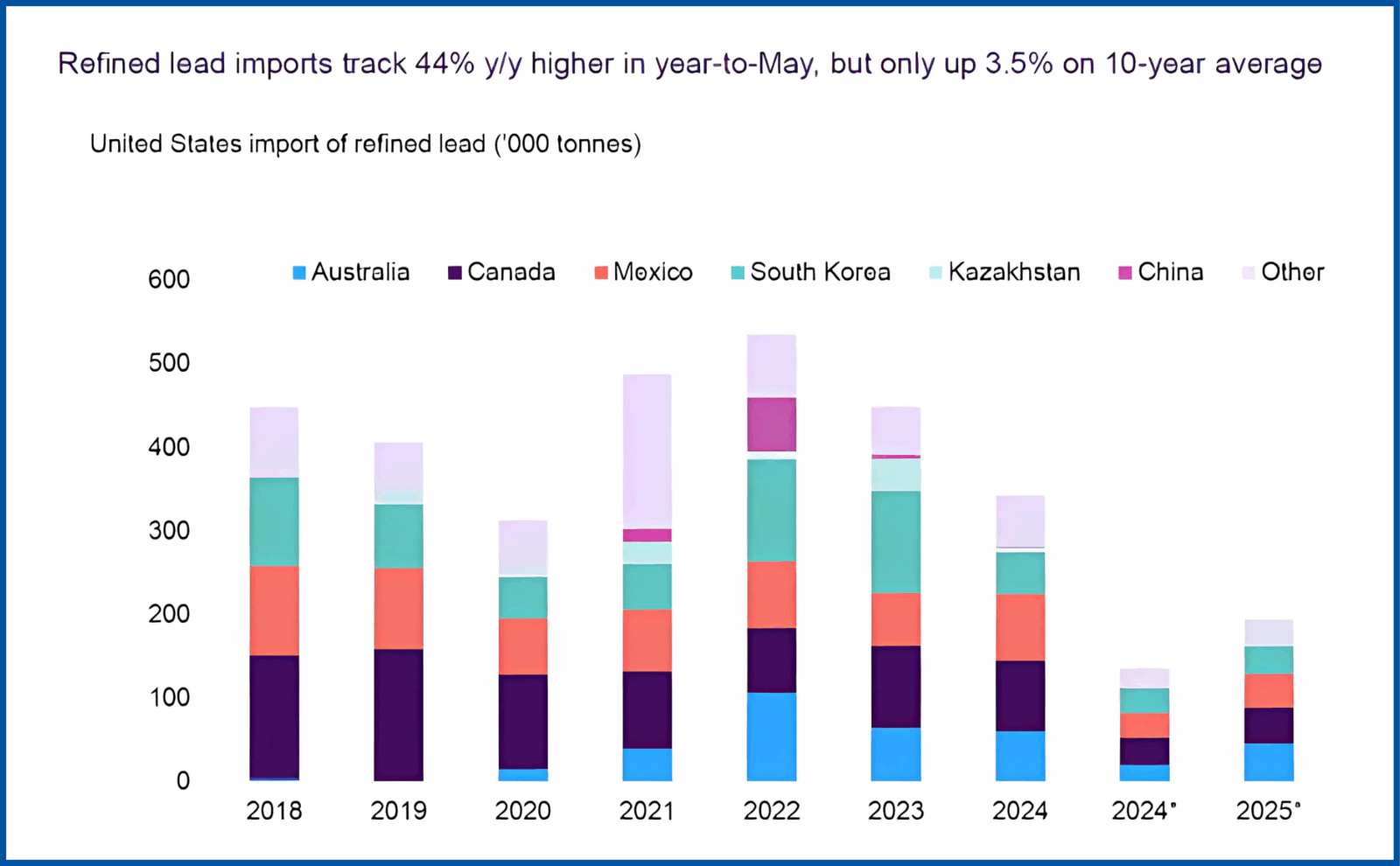

Recent trade disruptions are expected to cause near-term uncertainty around imports. However, as of the end of 2024 there remained a close partnership between lead suppliers and battery companies in the U.S., Mexico and Canada to service the continent’s battery needs. Outside of North America, the largest importers to the United States at present include Australia and South Korea – though when considered in the broader context of the roughly 2 million tonnes of lead that is required, these jurisdictions are not significant sources of overall U.S. lead supply.

“U.S. lead battery recycling is a tremendous success story, with a proven record of safety and sustainability. Our industry’s closed-loop process for battery materials provides the model for a resilient domestic supply chain,” said BCI President and Executive Director Roger Miksad. “We’re proud of this track record, but we still think there’s room for improvement. Increased recycling capacity would keep used battery materials onshore, and reduce the need for imports of both primary or secondary lead to meet North America’s growing energy storage needs.”

There are many reasons why battery recycling capacity and lead production has not kept up with the growth in domestic battery manufacturing, including unique regulatory challenges as well as commercial concerns. However, battery recyclers and lead producers understand the urgent need to protect U.S. supply chains and support the nation’s future demand.

“The U.S. is heavily dependent on imports for a vast range of critical minerals that are essential to our economy and national security, including the lead used in batteries,” said Jeremy Furr is Senior Vice President of Strategic Sourcing for Stryten Energy. “We take great pride in the fact that we are part of a vertically integrated, domestic supply chain for lead, and are committed to ensuring the nation’s energy storage industry has the raw materials it needs to keep America running.”

For more information on current data and future projections on lead demand and battery recycling trends, contact media@batterycouncil.org.