Clarios’ Rebecca Conway Presents at 2022 BCI Convention + Power Mart Expo

Lead battery’s quick rebound from the pandemic and continued growth were key takeaways from Rebecca Conway’s May presentation, “Transportation Market Update” at the 2022 Battery Council International (BCI) Convention + Power Mart Expo, held in Naples, Florida.

Conway is executive director of marketing and technical services at Clarios, a global leader in energy storage solutions. Her talk included a high-level review of the transportation market over the past year and provided the transportation battery forecast through 2027.

Reviewing 2020 to 2021 Growth

Overall, Conway said the lead battery industry has fared well, thanks to strong market fundamentals.

“I think we would all look back at the last two years and say it was a wild ride. But we are an essential industry and were able to rebound very quickly from COVID. We saw record demand.”

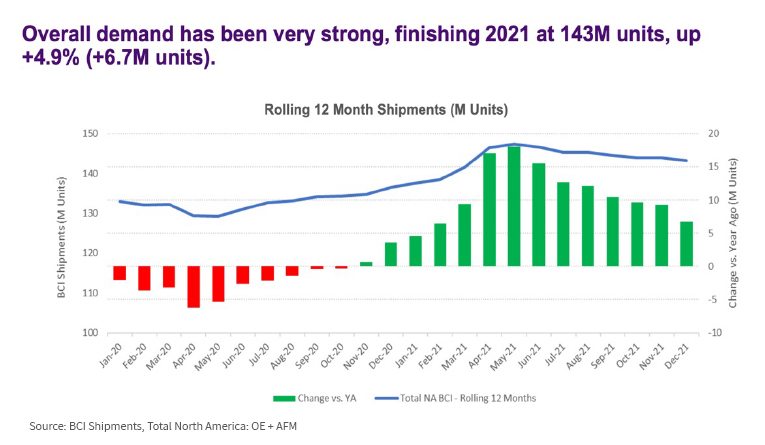

She began by presenting this overview data from 2020 to 2021:

- 2021 original equipment (OE) global OE production was 77.2M vehicles, up +2.6M vs. 2020 (+3%).

- Overall demand has been very strong, finishing 2021 at 143M units, up +4.9% (+6.7M units).

- Continued strong growth in both OE (4.2%, driven by growth in non-automotive segments) and Aftermarket (5%, with highest growth rates in Heavy Duty and Lawn & Garden).

Automotive Aftermarket: Growing and Aging Car Parc

Conway shared what is influencing the lead battery marketplace and shaping its dynamic future in the car parc.

By March 2022, monthly vehicle miles had rebounded to their prepandemic rate and are trending upward. The transportation industry is not only recovering from the initial impact of the pandemic, but COVID-19 motivated consumers to purchase their own vehicles.

At the end of 2021, there were 280 million vehicles in operation in the U.S., up over 21 million vehicles compared to 2016. Also, consumers are keeping their cars longer, meaning there are more opportunities and demand for car battery replacements. Average vehicle age creeps upward, now reaching over 12 years.

“We anticipate this trend to continue as the cohort of older vehicles continues to expand,” Conway added.

Strong Non-Automotive Segments

Another factor driving lead battery growth is the shift in consumer interests. The pandemic motivated more people to increase recreational activities, and lead batteries will continue to be a go-to resource and play a large role in this trend.

“Looking at the non-automotive segment, we continue to see strong growth,” Conway added, although it is slowing. She shared these statistics:

- New powerboat sales in 2021 totaled approximately 300,000 units, equating to the second highest sales year since 2007. The forecasted growth for 2022 is 3%. (Source: National Marine Manufacturers Association)

- New RV/camper sales finished 2021 at about 600,000 units, an increase of almost 40% compared to 2020. (Source: RV Industry Association)

Forecast Through 2027

Several factors will continue to sustain advanced lead battery growth into the next five years.

Continued Car Parc Growth

Lead battery growth will continue as people hang on to their vehicles longer and need replacement batteries. “All indicates show that, post COVID, people still want their cars … and cars are lasting longer.”

Strong Consumer Recreational Sales

In the non-automotive segment, the marine market will remain strong. Conway does not expect a recession among these products, but rather all-time highs.

“There was significant growth in recreational fishing and boating when the pandemic hit. Consumer spending in this category overall grew 30% in 2020, into a $31 billion industry.” RV sales are also starting out strong in 2022.

Heavy Duty Segment Growth

Off-road construction equipment demand is forecasted to remain strong, especially with passage of the $1 trillion Infrastructure Investment & Jobs Act in the U.S.

Impact of Technology Shifts

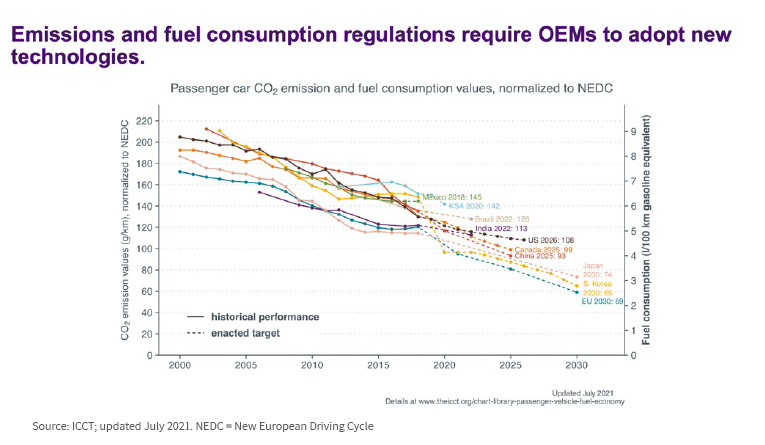

CO2 Emissions and Fuel Consumption Regulations Impact OEM Choices

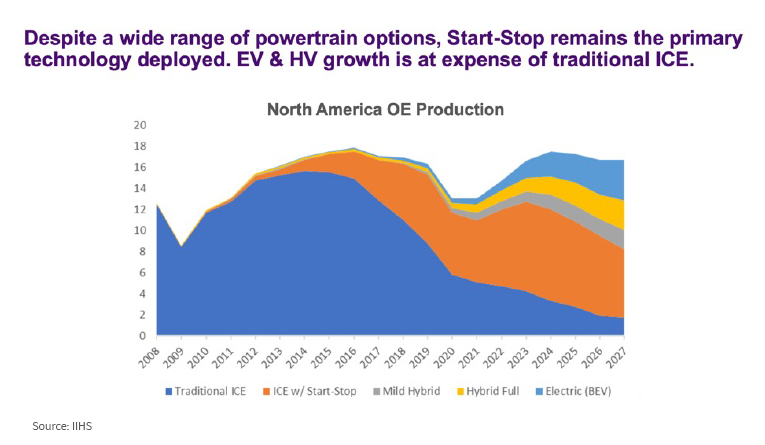

Though five main powertrain options exist, internal combustion engines (ICE) with start-stop technology remain the top choice for OEMs.

In Conway’s opinion, start-stop is the least disruptive and most cost-effective choice for OEMs to meet emission requirements, and it’s the least disruptive for consumers.

Nearly every new car and truck made today includes a lead battery for starting, lighting, ignition (SLI) functions, which can also support start-stop technology that can yield fuel savings ranging from 3%–10%. While hybrid cars have always had this technology, its use in non-hybrid cars and trucks is surging.

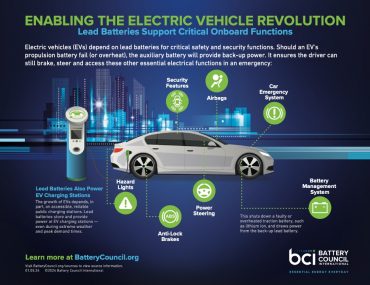

Electric Vehicle (EV) Adoption is Growing; Majority Have Lead Battery

Conway noted the opportunity here. “There is still a lead acid battery in the majority of EVs. [And] we’re also seeing an increase in the number of multi-battery systems – vehicles with more than one battery, a primary and auxiliary battery.”

Despite EV growth, consumers still prefer a traditional ICE vehicle. “It doesn’t require any change in behavior, so it’s pretty easy for them.”

Electric Vehicle Adoption: Millennials Have Highest Interest

EV sales will increase over time, but by 2030, the car parc will only be 4% EVs, 4% hybrid EVs and 5% micro-electric vehicles. However, EVs rely on lead batteries and will continue to rely on them as the EV revolution grows.

Based on age, research shows millennials have the highest interest in EVs. Their adoption has the opportunity to accelerate if key purchase barriers are addressed:

• Price

• Vehicle range

• Lack of charging infrastructure, with more demand to charge at home

Essential Lead Batteries Will Power Sustainability and Consumer Interests

Conway concluded by saying sustained, strong market fundamentals will keep the lead battery market strong.

“Our car parc is growing and aging, and consumers have taken on new recreational habits, like marine, which will be larger than they ever were in the past.” She also said OE production will rebound, but continue its shift to start-stop technology, which requires an advanced battery. “An AGM [absorbed glass mat, or advanced lead battery] is really the best choice.”

And, lastly, EV adoption has the opportunity to accelerate if key barriers are addressed.

Through it all, advanced lead batteries will continue innovating to meet the changing demands of consumers and vehicle manufacturers for reliable, sustainable, cost-effective energy storage.