Clarios’ Rebecca Conway presents at 2024 BCI Convention + Power Mart Expo

There’s good news on the horizon. The transportation market continues to power the North American battery industry’s solid growth. That’s according to 2023 industry data presented by Rebecca Conway at the 2024 BCI Convention + Power Mart Expo, held April 21–24 in Fort Lauderdale, Florida.

Conway is the executive director of marketing and technical services at Clarios, a global leader in energy storage solutions. Her presentation focused on the North American transportation battery market: How it performed last year, technology impacts, and forecasting through 2026.

Automotive industry powers continued growth

This was Conway’s fourth consecutive year presenting on the evolving transportation landscape. The data, primarily sourced from averaging information provided by BCI member companies, continues to be favorable.

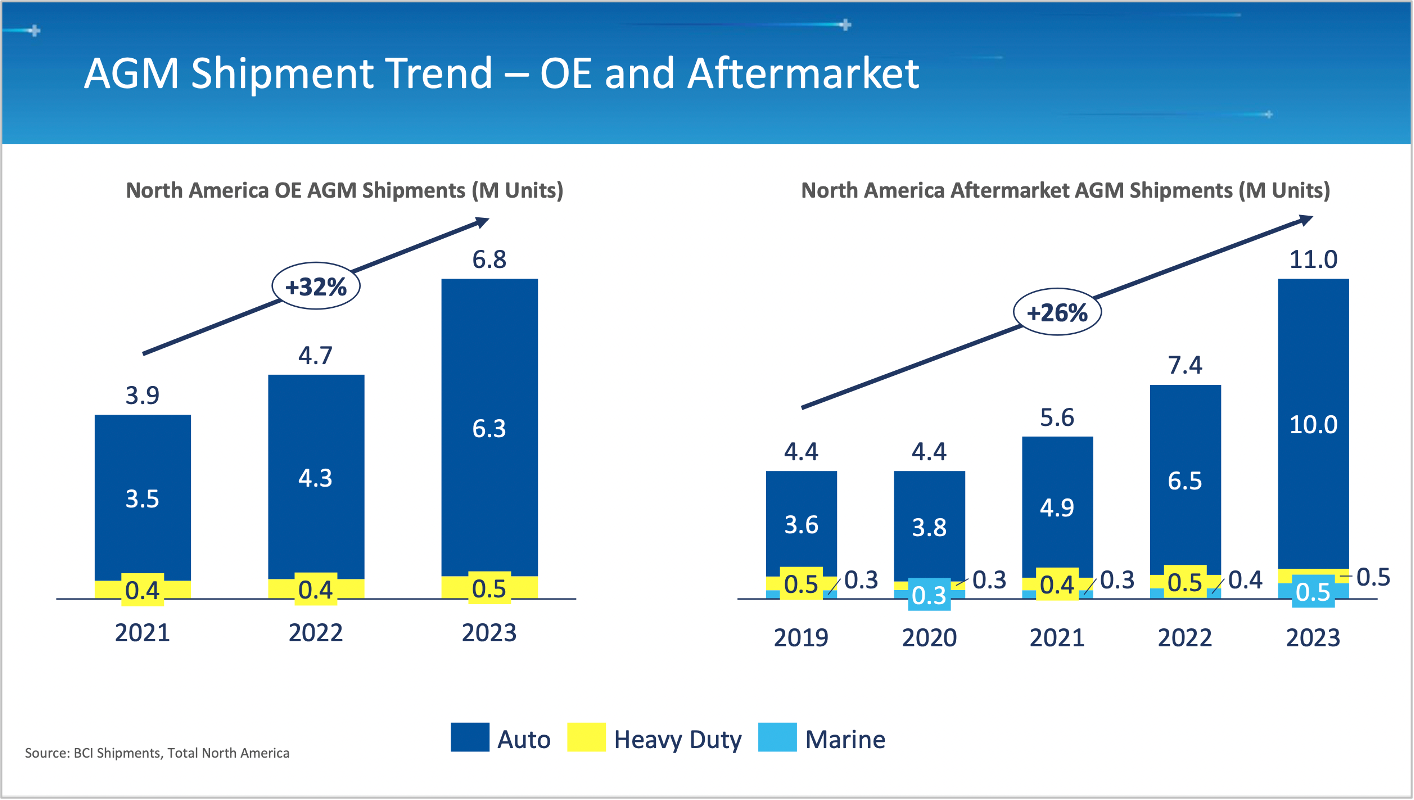

“We continue to see really, really strong market growth [across both OEs (original equipment) and Aftermarket],” said Conway, who shared key factors influencing growth and shaping the dynamic future of battery technologies:

- The market has strong fundamentals – growing car parc, increasing vehicle age (average is 12.5 years), and increasing importance on a battery’s role in vehicles and the need for multiple batteries within those vehicles.

- The battery market will continue to shift from SLI (starting, lighting, ignition) batteries to advanced battery technologies, reflecting the car parc’s transition to start-stop vehicles, hybrid vehicles and EVs.

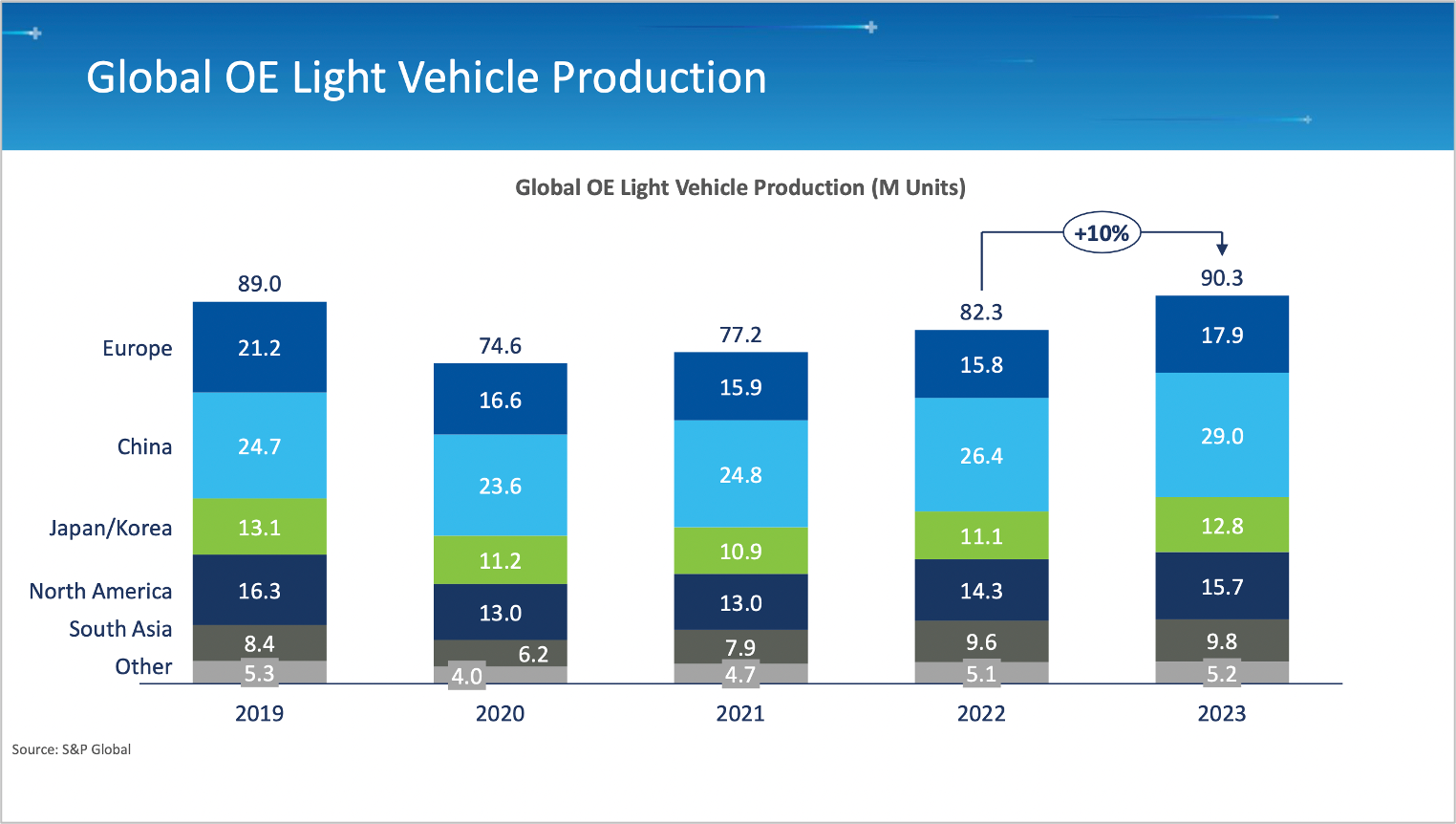

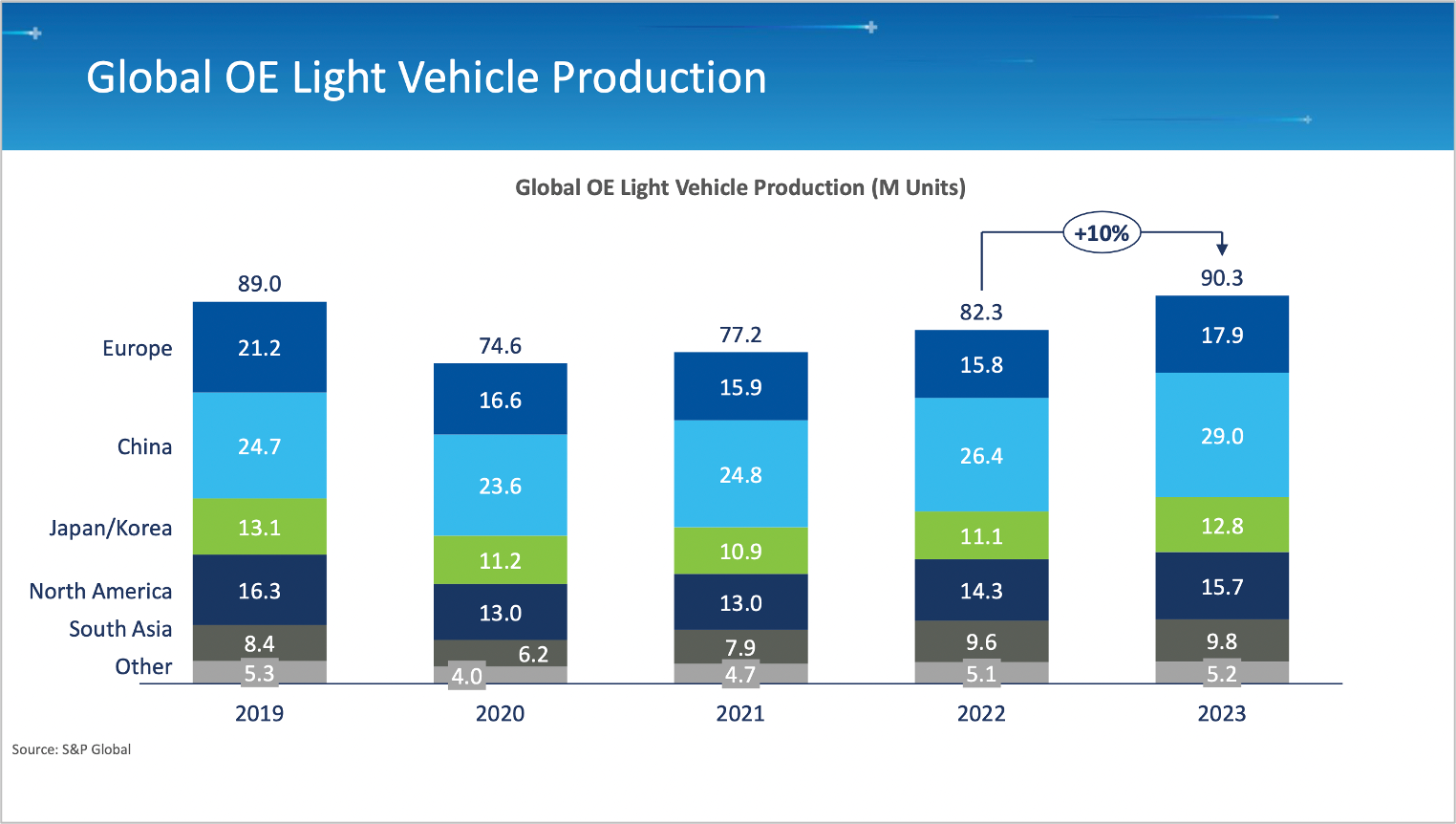

Rebound in global OE light vehicle production

Overall, there’s been a 10% increase in OE light vehicle production over 2022 to 90.3 million vehicles in 2023, according to S&P Global.

“We’ve seen a really strong rebound from an OE perspective. This is the first time we’ve exceeded the pre-Covid levels, after the dip in 2020, and it’s taken us a few years to get back to those levels,” reported Conway. “We did see strong growth across all the regions, with biggest growth across China, Europe, Japan and Korea.”

2023 North America lead battery OE shipments: “tremendous growth”

Overall demand has been very strong. Shipments in 2023 finished at 153 million units, up 3.2% (almost 5 million units year over year). Here’s how 2023 OE shipments looked by segment compared to the previous year:

- Automotive Market, the largest segment: Up about 18% (about 2.3 million units), from 13.2 million units in 2022 to 15.4 million in 2023.

- Heavy Duty Market: Up 30%, or 1 million units. This was attributed to Class-A semi sales and continued investment in machinery, driven by the federal infrastructure deal.

- Lawn & Garden Market: Up 31%.

- Golf Car Market: Down 40% year over year. Conway sees the biggest market risk here, from the shift to lithium-ion batteries.

2023 North American lead battery aftermarket shipments: “steady eddie”

Aftermarket shipments in 2023 finished up 1% over 2022, with automotive – two-thirds of the market – remaining what Conway called, the “steady Eddie.” Here’s how 2023 Aftermarket shipments looked by segment compared to the previous year:

- Automotive Market: Up about 1.5%.

- Heavy Duty Market: A bit lower; it’s struggled the most to recover since COVID. Fleet miles finished 2023 down -1.5% vs. the previous year.

- Lawn & Garden Market: Strong growth.

- Golf Car Market: Slowed down, reflecting shift to lithium-ion.

- Marine Market: Remained flat but retaining growth experienced in 2020-2021 when consumers found new recreational habits during COVID.

Technology update & powertrain forecast: a surge in start-stop

Conway said the main theme here is a slow-down in the push for full EVs.

“OE manufacturers have put out some really, really aggressive goals to shift their platforms to EVs. But we know there are a lot of barriers from a consumer adoption perspective,” Conway explained. While EV adoption predictions vary by source, she said adoption will depend on government incentives and charging infrastructure.

Conway shared this graph from the S&P Global Production Forecast (March 2024).

Overall, Conway remains “very positive” about the long-term forecast for the lead battery market. She said that one of the biggest take-aways from the S&P data was that start-stop technology is the top choice for OEMs. In 2023, 49% of vehicles produced were start-stop. The 2024 forecast is 54%.

“They [manufacturers] can make very few changes to their vehicle and meet the fuel efficiency requirements,” Conway noted. “A start-stop vehicle needs a higher performing battery. The vast majority of OEMs are choosing AGM for the power needs.” [NOTE: AGM is an absorbent glass mat, lead battery.]

She explained that no matter the powertrain, all of these vehicles have a 12V battery. The majority are a lead battery, and a lot of these vehicles have multiple batteries. Also, vehicles with start-stop technology will be coming into their first replacement cycle, fueling the aftermarket growth of AGM.

OE and aftermarket lead battery forecast for 2024–2026

Conway concluded by sharing her insights on what’s ahead for the North American transportation battery market. Other than the global OE light vehicle production data, the other forecasts are based on an average of BCI member forecast numbers.

- Global OE Light Vehicle Production – S&P Global forecasts continued growth, from 90 million units in 2024 to about 97 units in 2029. Most growth will come from China.

- North America Shipment Forecast – BCI members forecast between 3 to 4% growth (OE and Aftermarket). By 2026, total shipments will grow to 170 million units.

Conway’s shared her personal opinion on the bullish numbers.

“OE was up 18% last year. We’re not likely to see that continued strong of growth in OE. I think numbers are a bit ambitious. Aftermarket was up 1% and it stays steady, with the mature car parc that is growing and aging, but we don’t see a ton of opportunity for accelerated growth.”

Northern American forecast by market segment

- AUTOMOTIVE Shipments: Growing between 2 and 3% annually through 2026.

- HEAVY DUTY Shipments: About 4% annual growth, up 20 million units by 2026.

- MARINE Shipments: About 3% annual growth through 2026.

- POWERSPORTS Shipments: Grows from 7.2 million in 2023 to 9 million in 2026.

- LAWN & GARDEN Shipments: About 4.3% growth through 2026.

- GOLF CAR Shipments: An average 2.4% growth through 2026.

New technologies won’t replace proven battery technology

Conway acknowledged seeing more growth in lithium adoption in non-automotive segments. But the robust automotive market, regardless of powertrain choice and lagging full-EV adoption, means solid years ahead for the proven battery technology in the North American battery market.